Ultimate Beginners Guide To Real Estate Investing

Over the many years that we've been serving real

estate investors, one of the most asked questions

on our site has been, "How Do I Get Started in Real

Estate Investing?"

People from all over the world have been coming to BiggerPockets

to find the answer to that question. While some might lead you to

believe that there is a simple answer that works for everyone, that

simply isn't the case. We've built this guide to help simplify the

process of figuring out how YOU can get started. Of course, this

guide is not an all-encompassing "how-to" manual about every

aspect of real estate investing, but a broad-stroke overview of the

best ways to start down your path to financial freedom through real

estate investments.

What to Expect in This Beginner's Guide

This guide contains eight chapters, each focusing on a specific part of your investing journey. If you can

master these, you increase your chance of building wealth through real estate and minimize the risk of

failure or loss. This guide will walk you through the following:

Your Real Estate Investing Education

Before you start investing in real estate, it is imperative that you get educated in the important

concepts. There are dozens of ways to get educated and build your knowledge base, and Chapter 2

will focus on those areas in great depth.

1 | Ultimate Beginner’s Guide to Real Estate Investing

Choose Your Real Estate Niche and Strategies

There are a number of different strategies and angles from which to approach the business of real

estate investing. The more you focus on one specific thing, the better and more knowledgeable you

become at it. This will be the focus of Chapter 3, as we dive deeper into looking at the various

niches and strategies you can profit from in your real estate investing journey.

Create Your Real Estate Business Plan

As the ancient proverb goes, a house built upon sand is subject to collapse. By creating a strong

foundation that your real estate investing endeavors will stand upon, you will create a more

sustainable business that can weather the storms you may face. Chapter 4 will show you the best

ways to build that foundation to maximize the odds of your success.

Find the Best Investment Properties

When it comes time to actually make your first investment purchase, it is vitally important that you

don't pay too much and that you invest in the right kind of property. Chapter 5 will dive into the

specifics of how to set proper criteria to guide your investment decision

making.

Financing Your Real Estate Investments

Paying for your investment is much different than paying for a loaf of bread - and the method used

can often mean the difference between success and failure in a real estate investment. Chapter 6

will dive into the various financing tools you can use throughout your investing career.

Mastering Real Estate Investment Marketing

Regardless of what aspects of real estate investing you choose to focus on, you will undoubtedly

need to have a strong marketing skill set. Too many investors have the “if you build it, they will

come” mentality when it comes to real estate. Putting together the right marketing program and

allocating the necessary amount of resources towards it is absolutely crucial to the success of any

real estate investing business over the long term. Chapter 7 will focus on the marketing aspect of

your real estate investing business.

Knowing and Executing Your Exit Strategies

How you plan on exiting your real estate investments is just as important as the way you enter

them. Whether you sell, rent, or exchange your property, it is vitally important to have a clear

understanding of your exit strategy options for any investment deal from the beginning in order to

minimize your risk. Chapter 8 will discuss these exit options in detail to help you plot your real

estate investing course.

2 | Ultimate Beginner’s Guide to Real Estate Investing

Are You Ready to Begin?

As you work your way through this guide, remember that this is not all-encompassing. It is a 40,000 foot view

of how real estate investing works and is designed to give you the basic tools to get past the all important

question of how to get started. As you read along, make note of any questions or highlights, and then come

back to BiggerPockets.com and search the site or ask questions on our Forums to learn more about anything

on your mind. If you're unfamiliar with our site, BiggerPockets.com is an online community of real estate

investors with the web's largest collection of advice for new and experienced investors and is free to join and

to begin participating, learning, and growing.

“Starting any new endeavor can be scary. Our goal with Ultimate

Beginner’s Guide is to help alleviate the fears of new investors by giving

them the tools they need to be successful in their real estate investing

journey. ”

Josh Dorkin, Founder and CEO

BiggerPockets.com

If you are new to BiggerPockets, start with our real estate forums. The BiggerPockets Forums contain more

than 1,200,000 posts about every aspect of real estate investing, updated hundreds of times daily. Search

through the site or create a new thread and ask any questions you might have; many of our 270,000+

members will be there to help answer your questions. Also, check out the

BiggerPockets Blog, which holds

more than 6,000 articles from experienced investors in many different real estate investing niches, as well as

the

BiggerPockets Podcast, now the leading real estate podcast on iTunes. These sources, along with

hundreds of other pages on the site, make BiggerPockets.com the largest source of real estate investing

knowledge on earth.

Within these chapters, there are numerous links to additional articles and discussions found on

BiggerPockets. We recommend you take the time to scour these, as they will help answer many of the

questions you've got and will explore topics that are sure to be important to you on this journey. Of course, if

there are questions that this guide or the articles do not address, please be sure to ask them in our

real

estate investing forums.

If you are not a member already, please take a moment right now to sign up for a free membership on

BiggerPockets.com. Go to

BiggerPockets.com/signup.

It is perfectly natural to be intimidated, but our goal at BiggerPockets is to help you overcome your fears

and your countless questions by providing as much free information as possible to help you make the best

decisions for your own needs.

If you are ready to begin the Ultimate Beginner's Guide to Real Estate Investing, click below to turn to

Chapter 1...

3 | Ultimate Beginner’s Guide to Real Estate Investing

Real Estate Divider Are you new to real estate investing? Learning how to invest in real estate doesn't need to

be complicated, difficult, or expensive. In this beginner's guide, you will learn how to get started investing in

real estate from beginning to end - with no hype, false promises, or pitches.

THIS CHAPTER INCLUDES:

Can I Invest in Real Estate if I Have a Full Time Job?

Do I Need to Pay Some Guru in Order to Be Successful?

Can I Invest in Real Estate if I Have No Money?

Is Real Estate Investing a Way to "Get Rich Quick?"

What to Expect in This Beginner's Guide

WHY INVEST IN REAL ESTATE?

There are many different places you can stick your money other than under your pillow, including stocks, bonds, savings,

mutual funds, CD, currencies, commodities, and of course, real estate. There are positive and negative aspects of each

investment option, but since we're here to learn about real estate, we'll focus on that and that alone.

"Ninety percent of all millionaires become so through

owning real estate."

Andrew Carnegie

4 | How to Invest In Real Estate

One of the most commonly stated reasons that people give for

investing in real estate is that they are seeking out financial

freedom, but there are others as well -- of course, each person

will have their own personal reasons why. They are typically

seeking one or several of the following:

Appreciation

Cash Flow

Depreciation

Leverage

Tax Benefits

The decision to begin investing in real estate is a personal one, and we absolutely recommend you make sure

you and your family are 100% committed before deciding to move forward in doing so.

For more details on these reasons, see:

• Why Invest In Real Estate

• Top 5 Reasons to Invest in Real Estate

• Top 5 Reasons to Invest in Real Estate Instead of Paper Assets

Can I Invest in Real Estate if I Have a Full Time Job?

Yes. The kind of real estate investing you might see on television or might

hear about from a guru is not the only kind of real estate investing out

there. In many situations, that kind of investing is not even investing at

all, but simply gambling or speculating.

The truth is, there are

hundreds of ways to make money in real estate.

Some of these techniques or strategies might require forty hours a week,

while others might only require forty hours

per year

. The amount of

time it takes to grow your real estate business largely depends on your

investing strategy, your personality, your skills, your knowledge and your

timeline.

You’ve probably heard the age-old high school guidance counselor question, “If you suddenly had one million

dollars and didn’t have to work anymore, what would you do?” The answer, it’s said, is what career field you

should be in. Would you invest in real estate?

If your dream path would be to open up a shelter for abused animals or to move to Aruba and train tourists

to surf, you probably should not be a full time real estate investor.

5 | How to Invest In Real Estate

That's not to say that you shouldn't invest in real estate -- you just probably shouldn't go full time.

However, you don’t need to make real estate your career in order to build wealth in real estate. If you love

your job, you don’t need to quit it to invest in real estate. You can achieve the same or better results as a full-

time real estate investor by investing on the side.

“One of the perks of investing while working full time is the

steady income stream to fund and support your real estate

investments. Don't underestimate the importance of this!”

-Brandon Turner

Community Manager, Biggerpockets.com

Advantages of Investing While Working a Full-Time Job

By keeping your day job, you have several advantages over full-time investors. First, you do not need to live

off any of the cash flow you make -- that's what your 9-5 is for. By reinvesting all the profits from your

investments, you can fully realize the incredible benefit of exponential growth. Additionally, you have a much

easier ability to get long-term bank financing thanks to the stable income from work, which can also help

increase and stabilize your wealth building.

Investing in real estate while keeping your day job can be done in many ways, such as:

Partnering in a larger piece of property

Buy-and-hold property with property

management

Serving as a private or hard money lender

Investing in notes (mortgages)

Real estate can be highly profitable as a career or if you're just

investing while working a "normal job." However, the choice is

yours as to which path you take. Don’t simply decide to quit

your job and become a full time investor because you read

about other investors who have been successful doing it that

way. Having a concrete plan for how you're going to proceed in

real estate is essential; we'll get into that a little later in the

guide.

That said, life is too short to be stuck in a job you hate. Choose a career that makes you excited to wake up in

the morning, energized throughout the day, and content when you fall asleep at night. If that desire leads

you to full time real estate investing, welcome to the club! Just make sure you are not simply building a

career, but building a future.

6 | How to Invest In Real Estate

Also be sure to check out:

•

BiggerPockets Podcast 006: Investing While Holding a Full Time Job with Arthur Garcia

•

BiggerPockets Podcast 008: Learning to Be a Profitable but Ethical Landlord with Al Williamson

•

BiggerPockets Podcast 023: Flipping While Working a Job, Partnerships, and Military Investing with

James Vermillion

•

BiggerPockets Podcast 033: How to Close 27 Deals in Your First Year While Working Full Time with Sam

Craven

•

BiggerPockets Podcast 037: Full Time Income, Part Time Lifestyle Real Estate Investing with Aaron

Mazzrillo

•

BiggerPockets Podcast 051: Small Multifamily Properties, Working a Full Time Job, and Training

Tenants with Mike Sherwood

•

BiggerPockets Podcast 054: Investing in Under $30k Real Estate, Working a Day Job, and Good Vs. Bad

Neighborhoods with Lisa Phillips

•

BiggerPockets Podcast 058: Flipping and Wholesaling Homes While Working Full Time with Justin

Silverio

Do I Need to Pay Some Guru In Order to Be Successful?

Absolutely not. Countless investors have become successful without the

help of the guru crowd. The goal of many of these individuals is to sell you

on the dream of fast riches, fancy cars, easy money, and so on -- many prey

on people who desperately want to make money and often use very slick

and often dangerous (for you) techniques to sell you on their very

expensive courses, bootcamps, mentoring, training, etc. In fact, the tactics

used to get you hooked are very well documented, and there is absolutely

no such thing as a free lunch.

Keep in mind that there are many in our industry who benefit from the marketing of these gurus. Most

websites focused on the investment niche affiliate with them, making large referral fees -- often on the order

of 50% -- in return for marketing their wares. Additionally, a large percentage of real estate clubs derive their

revenues from products and events sold by gurus who "teach" there. And yes, they also get a nice 50% cut

for doing so.

Remember, real estate gurus are in the business of marketing and selling you on the dream. Through this

guide and the thousands of articles and hundreds of thousands of discussions available on BiggerPockets,

you can absolutely learn everything that you'd pay thousands of dollars to a guru for, and you can do so for

free. If you want to read an excellent article about the guru seminar trap, read "

The Real Estate Guru Trap –

How It Works & 4 Ways to Avoid It.

" Also, if you find a real estate guru that you are interested in learning

more about, be certain to be careful, and check out our

real estate guru review forum to find out the real

deal from other investors.

7 | How to Invest In Real Estate

That all said, they aren't all bad, and some of these individuals are very knowledgeable. Just remember:

caveat emptor (let the buyer beware). Do your homework and don't get caught up in the hype or promise of

secrets; there aren't any.

Also be sure to check out:

• Purchasing a Real Estate Investing Guru Program? Read This First!

• Don’t be hypnotized by the “Guru of the Week”!

• Real Estate Gurus Promoting Other Guru Courses and Events – a Scam?

• BP Podcast 017 – Finding Mentors, Facing Retirement, and Note Investing with Jeff Brown

Can I Invest in Real Estate if I Have No Money?

The simple answer is: yes, it is possible to invest in real estate if you

don't have any money at all. However, there is money involved in every

real estate transaction. The issue, therefore, is not whether you're

investing with "no money," but instead whether you’re investing with

"none of your own money." Investing in real estate without using any of

your own money requires using Other People's Money (OPM) -- learning

to strategically invest in real estate without any of your own money is

one of the most complex but important tools you can develop in your

real estate investing career.

The key to investing in real estate without any money of your own is simple: bring something to the table. If

you lack money, there are other things you can bring to the table in a transaction -- if structured correctly --

including education, time, connections, confidence, intelligence, and creativity. By reading this guide, you are

already taking steps toward building your strengths in those areas.

Many investors use little or none of their own money when investing in real estate by using one of several

methods that include:

Wholesaling

Using partners

Using lease option strategies

Via FHA 3.5% down payment loans

Using USDA or VA no-down payment loans

With home equity loans or lines of credit

Using private/hard money.

8 | How to Invest In Real Estate

We will look at each of these areas in more depth later in this guide, but we want you to recognize that

investing in real estate without income is possible, but may not be as easy as the gurus would have you

believe.

For more information on investing in real estate without any money, please see:

•

5 Ways to Start with No Money and No Credit?

•

How to Close a Subject-To Deal with No Money Down

•

Can You Really Flip Houses With No Money?

•

Forum Discussion: Wholesaling With No Money Down

•

Flipping, Marketing, and Wholesaling with Danny Johnson

•

BP Podcast 050: Getting Started and No Money Down House Flipping with Mike Simmons

Working in Real Estate Without Investing at All

Many would-be real estate investors get their start by simply working in the real estate industry – earning

money while gaining a solid hands-on education. Here is a brief list (far from exhaustive) of careers you can

take on to learn the real estate business:

Real Estate Agent

Mortgage Broker

Appraiser

Construction Worker

Resident Manager

Title/Escrow Agent

Project Manager

If you are looking to get into real estate investing with no experience and no money, choosing one of these

careers may be a great way to get your feet wet in the industry and to help you begin plotting your career

into full time real estate investing. The experience you'll gain from mastering one or several of the other

trades in the industry can be invaluable in helping you be successful.

Is Real Estate Investing a Way to "Get Rich Quick?"

How many late-night real estate infomercials have you seen where the real estate guru is sipping drinks on

the back porch of his beachside home, next to beautiful women in expensive (or minimal) clothing, telling

you that this life is for you?

9 | How to Invest In Real Estate

No doubt one of the largest draws to real estate investing is the image of investors driving fancy cars, living in

large homes, and being all around "rich." While many real estate investors do build significant wealth over

their career, real estate investing is not a "get rich quick" scheme. Yes – there are some who make a lot of

money in a short time; however, these situations are generally the exception, not the rule.

Investing in real estate takes planning, patience, and persistence. Don't expect to make millions of dollars in

your first year. Instead, plan on creating a business through real estate that will grow steadily year after year

to enable you to meet your financial goals -- and hopefully your dreams. No matter what you might hear

otherwise, being successful in real estate requires hard work, just like it does in any other field. It is also

important to know that there are no shortcuts to being successful in real estate -- there are no products or

tools that will do the work for you, either. You must learn the fundamentals and then apply them. Of course,

our goal here is to help you with that.

For more information on "get rich quick" investing see:

If You're Not Building Wealth – You Might Be in

The Wrong Game

Forum Discussion: Real Estate: A Get Rich Slow

Business.

Slow and Steady Wins the Race

FAST Nickels vs. SLOW Dimes: As a Real Estate

Investor, Which is Better?

Moving On

By the end of this chapter, you should have a clear vision for why real estate can and should be an important

step for building wealth for your future. Whether you decide to go full time or just invest on the side, real

estate can be the path toward financial future for you and your family. In the next chapter, we are going to

look at the very first step (and one of the most important) you should take on your journey: your education.

When you are ready, turn to Chapter 2 and let's get you on your way to starting out in real estate.

10 | How to Invest In Real Estate

"A journey of a thousand miles begins with a single step."

Lao-tzu

This chapter is very important in your real estate investing

journey. Without a clear understanding of the principles found

in this chapter, you are at a much higher risk of failure and

defeat in your real estate dealings. In fact, if you only

remember one chapter in this entire guide, we sincerely hope

it's this one. Let this be your first step to a successful future in

the real estate investing world.

In this chapter, we'll cover:

Don't Skip Your Real Estate Education

Real Estate Terms and Mathematics

Mentors, Gurus, and You

Overcoming Fear

Analysis Paralysis

11 | Real Estate Investing Education

Don't Skip Your Real Estate Investing Education

As we discussed at the end of chapter one, real estate investing is not a “get

rich quick” scheme. Just as any solid home needs a strong foundation, the

same is true when it comes to your real estate education -- a solid foundation

is key to a long-lasting business.

This guide, while not exhaustive on every aspect of real estate investing, will

help develop that foundation. We put it together to be a first step in your real

estate education – and as an introduction to the possibilities that come with

real estate investment.

There are many different ways to get educated in real estate investing, and

you don't need to pay hundreds or thousands of dollars to learn the business. Below, you'll find a list of a few

sources of real estate investing education; be sure to consider each before making a final decision on how

you're going to move forward -- what works for one person may not work for another.

Sources of Real Estate Investing Education

Books -- real estate booksAs the old saying goes, “Those who lead,

read.” Books are fundamental in gaining an education in real estate and

perhaps the most widespread learning method for investors. Real

estate books are produced each year by the thousands, and every

major bookstore in the world contains a whole section on real estate

investing. Chances are, if there is a way to make money from real

estate, there has been a book written about it. If reading books,

however, is not within your arsenal of skills, you are in luck. Today, we

live in a world where nearly every new book is also made into an

audiobook. (Try Audible.com for the web's largest selection.)

Blogs -- real estate blogsBlogs, short for an older term called a “Web log” are a

collection of short essays written about a topic. Blogs can be an amazing source of

information, and there are fantastic ones for every topic you can imagine. There

are many great ones written by people living in the trenches of real estate worth

checking out and learning from. Be sure to check out the BiggerPockets Blog,

which features dozens of expert contributors sharing their best tips and advice, as

well as the BiggerPockets member blogs (TK) for great examples of real estate

blogs. You can also see a list of BiggerPockets' “Top 35 Real Estate Blogs” and discover new favorites.

Mentors -- real estate mentorsPerhaps the most powerful way to gain a good education in any field of study

is through a mentor -- and the same holds true in real estate. While there are dozens of professional real

estate mentors who charge for their service, there are also millions of mentors all over the world that will

cost you as little as a cup of coffee - they are your local investors. People enjoy sharing what they know, and

12 | Real Estate Investing Education

seasoned real estate investors are no different. By introducing yourself to a successful

local real estate investor who you would like to become more like, you'll have the

opportunity to learn from someone in the field who knows your market and who can

ultimately become a partner as you come to become successful yourself. We'll talk more

about mentors later in this chapter.

Podcasts -- real estate podcastsOne of the newest innovations in the world of real estate

investor education is the Podcast. A podcast is simply a recorded audio program, similar to a

radio show, that can be produced by anyone with a computer and a microphone. There have

been a number of great podcasts that have emerged in the last few years. If you have a

smartphone or MP3 player, you can listen to hundreds of hour long shows covering a wide

variety of real estate topics whenever you want – whether in the car, jogging, or lying in bed --

for free. Be sure to check out the pitch-free BiggerPockets Podcast or search iTunes for other

options.

For more information about gaining a solid education, check out these posts:

Real Estate Guru Courses: Are They Worth It? Do I Need to Pay Some Guru in Order to Be Successful?

5 Books That Keep Me Focused As A Real Estate Entrepreneur Is Real Estate Investing a Way to "Get Rich

Quick?"

What Is Wrong With Paying For Mentoring, Coaching Or A Guru’s Program?

Continuing Your Education is Key for Real Estate Entrepreneurial Success

Real Estate Investing Education in the Information Age

Bigger Pockets Radio Podcast 003: Getting Started in Real Estate and Raising Money with Brian Burke

BP Podcast 011 : The Ultimate Beginner’s Podcast For Real Estate Investors

Real Estate Mathematics: No More Complex than Junior High

You don't need to be a college calculus student to

understand real estate math. In fact, most of the

math you'll need is grade-school level. This section is

going to quickly touch on some of the basic concepts

and math formulas you'll need in your real estate

investing career.

13 | Real Estate Investing Education

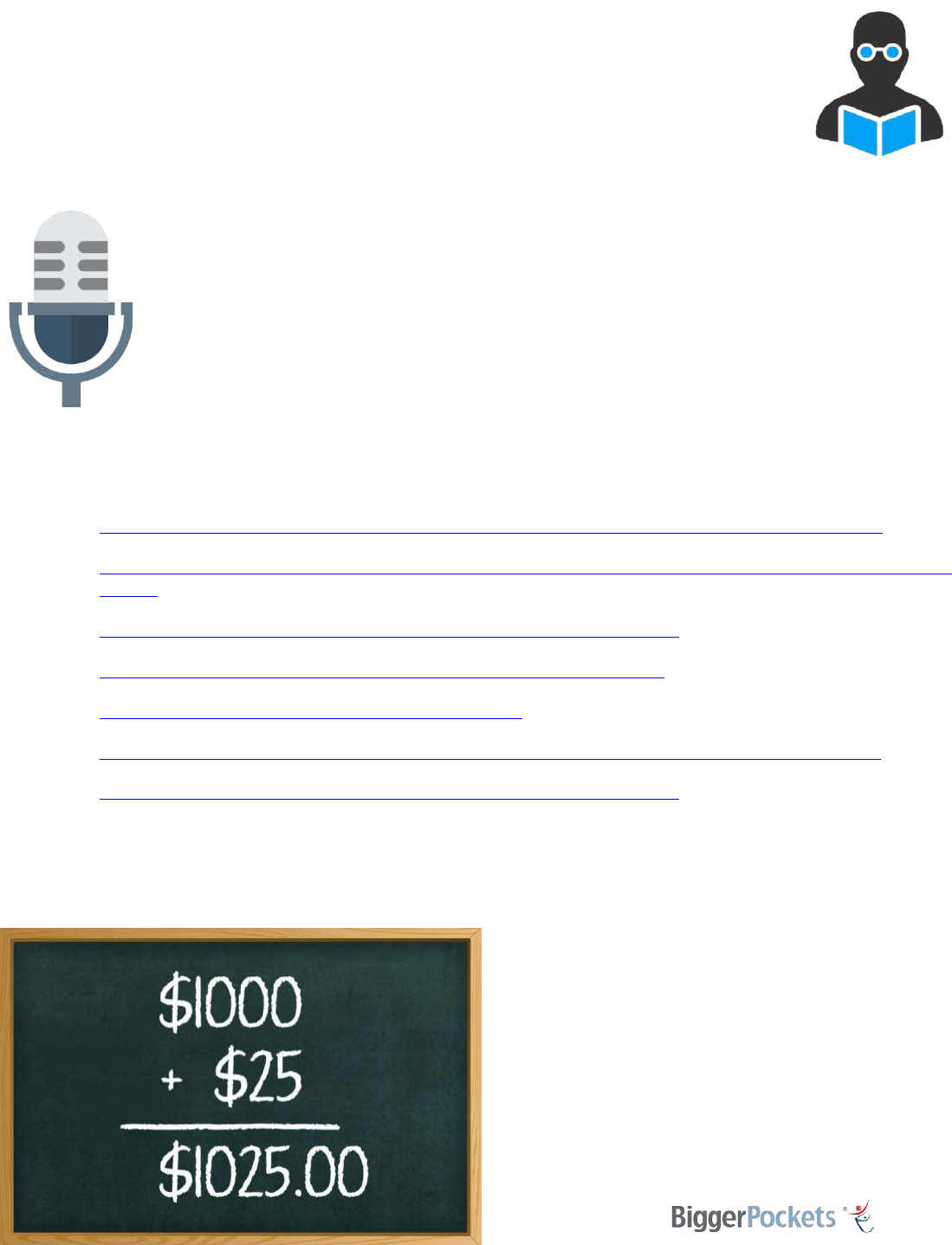

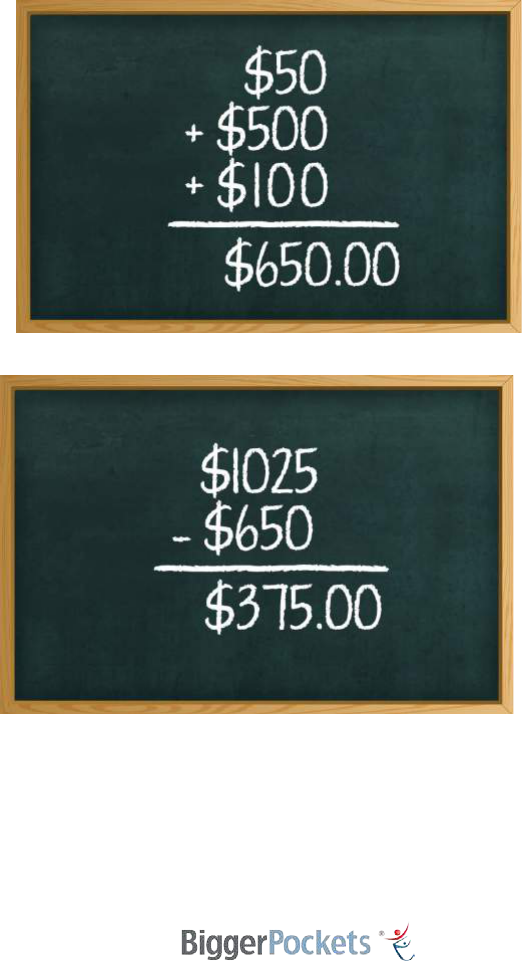

Income:

Income is simply the amount of money that comes in from a property. This math is perhaps the easiest of all:

simply add up the amount of rent and any additional fees that comes in.

For example – you own a rental house. The home rents for $1000, and the tenant also pays $25 for the use of

the garage.

Your total income was $1025.00.

Income could also include late fees, application fees, pet fees, laundry or other vending machines, or any

other value you receive from your rental.

Expenses:

Expenses are simply the things that cost you money on

an investment. For example, the garbage bill for a home

is $50 per month, the loan from the bank was $500 per

month, and maintenance was $100 per month. The total

of these three expenses is $650.00.

Your total expenses for this example were $650 for this

particular month. Keep in mind that there are many

other expenses that you'll face as a real estate investor,

including things like taxes, insurance, management,

holding costs, capital expenses and various others.

Cash Flow:

Cash flow is simply the amount of money left over at

the end of the month after all expenses are paid. To

determine the cash flow, simply subtract the total

expenses from the total income:

Your total cash flow in the above example property was

$375.00 for the month. Let's look at a few more math

equations.

14 | Real Estate Investing Education

Return on Investment:

Real Estate MathYour “return on investment” (also known as ROI) is a fancy

way of describing what interest rate you are making on your money per year.

For example, if you invested $250 and you made $250 from that investment

(for a total of $500) over the course of one year, you would have made a

100% return on investment. Similarly, if you invested $5000 and made an

additionally $2500 over the course of a year (for a total of $7500) you would

have made a 50% return on your investment.

The actual calculation for Return on Investment looks like this:

ROI = (V1 – V0) / (V0), (where V1 is the ending balance and V0 is the starting

balance)

A simple scenario for using ROI to calculate an investment return would be as follows: On January 1, you put

$1000 into a bank account. On the following January 1, you cash out the account for $1100. Your ROI on the

investment is:

ROI = (1100 – 1000) / (1000) = .1 (or 10%)

You start with $1000 and end up with $1100 after a year for a return of 10%.

These simple concepts present the foundations upon which almost all other real estate calculations are

based. The rest will come in time, but most calculations are simply related to these.

For more information regarding real estate math, please see:

Introduction to Real Estate Investment Deal Analysis (A great comprehensive blog post about real estate investing math)

Introduction to Internal Rate of Return (IRR)

Return on Investment (ROI) Versus Cash on Cash Return (CCR)

Real Estate Investing Mentors:

A mentor is an individual who comes alongside you to teach and instruct based on their first-hand

experience; they are someone who has lived the life before – walked it, talked it, and breathed it. Finding a

mentor and learning from those who have come before you is one of the most important steps you can take

in your real estate investing education, yet perhaps the most misunderstood. This section is going to focus on

what a great mentor is, how to find one, and it will look at the question, “Should you pay for one?”

15 | Real Estate Investing Education

Real Estate Investing Mentors in Your Life

In your life, who have been your mentors? I'm not talking just real estate – but life in general. There are a

number of different individuals who may have served in a “mentor” role at one time or another, such as:

Parents Professor

Grandparents Boss

Older sibling.

Among all these mentors, there exists a common thread that all these sources has: an existing relationship

with you.

These individuals were first in our lives through an existing relationship, and the mentoring relationship grew

organically out of it. It wasn't forced or manipulated. There was no formal “mentorship agreement” written

ahead of time, no payment required for mentorship, no force. The only requirement was the relationship.

How to Find a "Organic" Real Estate Mentor

Real Estate MentorsFor those who have been taught that the only mentors are the kind

that cost $19,997.97, the concept of an organic mentor is a profound thought. After all,

why would a seasoned professional real estate investor bother to help a newbie? "Won't

I just be wasting their time?"

There are a variety of reasons why a seasoned real estate investor might choose to help

a newbie, but the fact is, many do. Whether it's the dream of passing on their legacy,

having someone with similar interests to talk with, or the potential making future deals,

organic mentorships happen each and everyday. These mentorships are usually called

by another name, though: friendships.

On the other side of the spectrum, there are new wannabe investors who tend to

approach the relationship as if the mentor should be lucky to work with them. This

entitlement attitude leads many of these individuals over to the BiggerPockets Forums, where they proudly

announce that they are looking for a mentor to teach them all they know, but offer nothing in return but the

privilege of working with them.

In other words

“Hi, my name is (so and so) and I'm looking for someone to invest a significant portion of their time and

energy telling me how to get rich. I offer nothing to this relationship, but expect you to jump at the chance

because you probably have nothing better to do. Most likely, I'll just disappear once I realize I can't get rich

overnight, leaving you exhausted and irritated. So, who's first!?”

If you would like a mentor to come into your life, instead of your search being all about you and what you

need, seek ways to grow a mentorship organically. Try these tips for building those relationships:

16 | Real Estate Investing Education

Concentrate first on establishing a relationship with seasoned investors who you would like to learn from. A

mentor doesn't need to be Donald Trump or Robert Kiyosaki. A mentor can be the investor down the street

who owns a half-dozen rentals and works a full time job or an active BiggerPockets member who donates his

or her time to answering questions in the forums. The key is finding an individual who you want to learn

from in the field you want to enter. While you can glean a lot of information from any successful investor,

attempting to build a deep mentorship with a mediocre house flipper, when all you want to do is buy and

hold small multifamily properties, is probably not a great first step. Seek out individuals who are doing what

you want to do.

Make yourself valuable in a way that is meaningful (profitable) to the other person. What can you offer the

other person who you want to learn from? Do you have a free weekend that you can offer to help clean up a

vacant unit? Do you have web design skills or cold-calling skills? Value is found in many different forms to

many different people. Make it your goal to provide solid value to every relationship you have. Additionally,

you don't necessarily need to do everything for free for that person. If you are handy, perhaps just being a

dependable maintenance person who doesn't rip them off is enough to build that relationship. Maybe a well

designed website could be your value proposition. Whatever it is – remember: provide value.

Don’t expect anything in return. You didn't build your early mentorships (parents, grandparents, etc.)

expecting something in return. You built them because you were simply going through life. Provide value and

in return – you may receive something back – but don't expect it.

Always think “win-win” — Don't simply focus on what’s in it for you. Your mentor may be far more successful

than you – but that doesn't mean you can't help them become even more successful. As the popular phrase

states, "a rising tide lifts all ships."

Most successful investors are willing to help, but only after you have proven that you are worthy of their

involvement. A mentor does not want to waste their time. Being a mentor is a huge undertaking for both

sides, and no one wants to devote a significant amount of time and effort building a relationship only to have

it fall apart when the student gets bored. Prove that you are in this for the long haul by persistence, building

knowledge, and actively growing outside the relationship you are building.

Should You Pay for Mentorship?

Real Estate mentor The role of a mentor is to make the journey from

point A to point B a little quicker and a little easier. For many wannabe

investors, paying for a mentor is the quickest and easiest way to find a

mentor. But should you?

If you've been around BiggerPockets for any length of time, you'll

understand that it is our core belief that you do not need a paid

mentor or guru to help you succeed. There is a vast amount of

information out there, most of it for free, that you can use to learn

and grow as a real estate investor. Furthermore, places like the

BiggerPockets Forums give you the ability to ask any question you

want and receive answers back from many actual, seasoned real

estate investors. Think about it -- there are over 219,000 others on our

17 | Real Estate Investing Education

site, and many of them are active on our Q&A forums -- you can pay a single person thousands to be there to

answer your questions or you can just ask it for free and get answers from many of your peers who are

active in the field. We tend to believe that the input of many is certainly superior to one person's.

With that said, the choice to pay for mentorship or training is 100% up to you. The role of a product or

training from a guru should be to improve your processes and make your journey easier, not necessarily

shorter. The theory is, if you spend $500 on a product that helps you achieve $1000 in profit, then the

product is worth it. The problem is that most individuals simply choose to buy a product looking for a

shortcut and do not actually put into practice the lessons taught.

Before ever paying for training, we recommend that you first exhaust all options for finding a local mentor,

as we discussed above. A paid mentor will most likely be unfamiliar with the intricacies of your local real

estate market, while a local mentor will usually have a much better grasp. If you cannot find a local mentor,

next seek out knowledge via books, forums, blogs, and other sources. Besides gaining knowledge and

pointing you in the right direction, this also will help guarantee your full commitment. After all, you don't

want to pay hundreds (or thousands) of dollars just to lose interest next week.

“If you are searching for the right opportunity to grow as a real estate

investor, before searching the internet for the perfect solution or pulling

out your credit card to hire the perfect coach, search yourself. Make sure

you know what you are looking for, and why, and then match your

needs with the solution that fits and feels the best.”

Chris Clothier, Investor

When you have a firm grasp on the type of investing you want to get into – then, and only then, should you

consider paying for mentorship. Before you do, however, be sure to check out the

Guru Review Forum on

Bigger Pockets, as well as the

Better Business Bureau. Be very wary of shining reviews online from members

that show up at a site just to defend some program (these are often paid members of the organizations

themselves). Additionally, there are many gurus out there who simply exist to re-package free information

and sell it for exorbitant amounts, claiming to have secrets or some new methodology. Do your research

ahead of time to avoid working with these scammers.

Finally, before paying for a mentor or program, follow this one final step: Wait! Oftentimes, pitches and

pressure applied from the individuals promoting a program are effective at striking the emotional nerve and

as a result, can encourage you to buy out of fear or on excitement, rather than prudence. Wait a few weeks

to see if you are still as interested. Many times, when the daze from the salesman’s shiny new suit wears off,

the program is suddenly not as appealing. After all, there is a reason they want you to “sign up TODAY!”

Paid mentors can provide accountability (“I spent thousands... I better make it worth it!”) and good

information that is neatly packaged for easy consumption. Many investors do find success working with paid

mentors. Many others, however, do not. By focusing on finding local mentors, building your knowledge, and

18 | Real Estate Investing Education

researching your potential paid mentor before paying, you are able to increase your chances of finding

success and avoiding failure. Remember: there is not a product, coach, or mentor who can make you

successful. That is strictly up to you. A mentor – paid or not – is merely a guide to help you get down the path

as safely and quickly as possible. The choice to do so is up to you.

For more information on mentors, gurus, and paid programs check out:

Life Changing Mentors

How Do You Find a Real Estate Investing Mentor?

How to Find Real Estate Mentors and My Eureka Moment

I Can Do That! No, Sorry, You Probably Can’t – Wannabes and Mentorship

The Real Estate Guru Trap – How It Works & 4 Ways to Avoid It

Purchasing a Real Estate Investing Guru Program? Read This First!

Don’t be hypnotized by the “Guru of the Week”!

BP Podcast 017 – Finding Mentors, Facing Retirement, and Note Investing with Jeff Brown

BP Podcast 025: Four Newbies and Their Very First Real Estate Success Stories

Fear: A Roadblock in Real Estate Education

I never worry about action, but only inaction. – Winston Churchill

Fear For every successful real estate investor out there, there are dozens who were too filled with fear and

uncertainty to ever actually do a deal. If you are just beginning, chances are you have some fear as well – but

don't worry; fear is a natural part of life and is designed to help us avoid bad decisions and the consequences

derived therefrom.

However, fear can also stop you from ever getting started, and as a result, you may find yourself spinning

your wheels without getting anywhere. This purpose of this section is to address that fear, to teach you how

to overcome it, and to help you succeed in spite of it.

Six Steps to Help You Overcome Fear:

1.) Get off Your Duff.

If you are looking to real estate investing to save you from a job you hate, then you had better start working

to replace the income from your job with money made from real estate activities. Develop a plan and work

that plan everyday -- just like you would get up and go to work everyday for a paycheck. If you expect to do

one deal and end up on a beach somewhere with beautiful people all around -- wake up. Successful real

19 | Real Estate Investing Education

estate investors work hard, and you will need to do the same, but instead of working for a company you're

not fond of, you're working for yourself -- a blessing and a curse.

2.) Commit

Actions-process-stop-icon STOP buying courses and other materials or seeking out

mentors or coaches until you are committed to step number one above. If you are

not committed, no course, class, or trainer is going to get you any closer to your

goal. Almost every real estate course out there focuses on the mechanics, but the

real action is what’s going on between your ears. When you can get that under

control, it won’t matter what technique you use; you will find success as a real

estate investor! Realize that you could spend a lot of money having someone show

the mechanics, but if you are not willing to deal with the “conditioning” issue, you

are just wasting money.

3.) Start Participating

BiggerPockets is filled with knowledgeable real estate investors who are

willing to share what they know for free. Sign up for an account and interact

daily. Don't just lurk; participate, ask questions, connect with others, and

build relationships. If you are afraid to ask questions, then you are going to

be just as afraid to speak with a seller who needs to sell you their property

or to negotiate with a big city developer. Interactions are part of an

investor’s life, so the faster you can overcome this fear, the more successful

you'll be. Being visible to your peers online and off will ensure you're always

at the front of their minds -- and that's great for business.

4.) Learn the Lingo

Without knowing the lingo of a real estate investor, you will always be afraid of sounding like you don't know

what you are talking about. Once you build up your confidence in understanding the lingo, your ability to talk

with others and understand what is being discussed will grow exponentially.

5.) Learn the Concepts

Once you have the lingo down, you need to start understanding the concepts. If you can't adequately explain

what debt-to-income is or why 70% ARV is important in a house flip, you need to spend more time learning.

Fear is often a result of being unclear. Look back at chapter three to see ways you can gain more knowledge.

Additionally, once you have a good understanding, help teach someone else. Teaching others a difficult

concept will cement that concept into your own mind, helping you never forget.

20 | Real Estate Investing Education

6.) Watch Others

By assimilating yourself with investors who are involved in the same kind of

investing you want to get into, you will naturally begin to pick up on the

traits that make them successful. If this means working nights and

weekends for a local investor for free, then that's the price of admission.

You will quickly learn to overcome your fear when you help others

accomplish success, giving you the confidence to strike out on your own.

All investment has some degree of risk, and real estate investing is no

exception. While risk can’t be avoided, it can be managed through proper

preparation, which you have already begun by reading this guide. The

hardest thing to do in any new venture is to get started. At some point, you

need to follow the advice of Nike: "Just Do It!"

Analysis Paralysis

It's easy to get stuck in the world of “Analysis Paralysis.” These are

the moments where you research, plan, evaluate, research, plan,

evaluate, in an endless cycle and are paralyzed from ever actually

taking action. It's the problem of reading books without

implementing, reading blogs without engaging, and meeting others

without interacting. Typically, it’s due to fear of screwing something

up.

It’s easy to convince yourself that you don’t know everything you

should know before you start taking action. However, you don’t

need to learn about every single niche buying technique, and you

don't need to be an expert before getting your hands dirty. You

should focus on one area of investing and become an expert in it

and then move on to the other techniques and areas. We'll cover

the various real estate niches in the next chapter of this guide.

Once you know where you want to start, you need to learn the ropes. The

BiggerPockets Forums are an

excellent place to learn everything you need to know about any topic. Ask questions. Learn the basics and

start planning. You might feel that you are not completely ready to begin, and you probably never will be

unless you take action. It will seem scary, and you probably won’t be able to answer all the questions that will

be asked by sellers and buyers once you get started. But because you took action, you will be in a position

that will force you to learn the answers to those questions -- remember, that's what this site is for -- which

will help when those things come up.

It’s so much easier when you're fearful to spend more money and buy another course or to spend another

month reading about what other people are doing. Doing so won’t get you anywhere. Get educated, get your

plan together and start taking action. As you do, you will quickly get to where you feel right in your new skin.

You will actually feel like a real estate investor. Your confidence will skyrocket, and you will become even

better at what you do.

21 | Real Estate Investing Education

For more information on Overcoming Fear and Analysis Paralysis, check out:

Advice for New Real Estate Investors Just Starting Out

3 Words of Advice for New Real Estate Investors

Overcome Your Fear to Get Started as a Real Estate Investor

Being Committed to Being Committed

Paralysis by Analysis

Avoid Getting Stuck in Real Estate Investing’s Paralysis of Analysis

Frozen by Paralysis of Analysis?

5 Ways to Overcome Analysis Paralysis

Moving On

Beginning your investment career with a solid foundation based on a good real estate investing education is

vital to the success of your career. There are many different ways you can learn and grow as an investor, so

choose the method you feel you can grow the most with and start learning.

The next chapter will help further your education by teaching you more important basics of the real estate

business, including different real estate niches and the basic strategies available to you. Once you learn

these, you'll be ready to start with the all important planning that we've been talking about.

22 | Real Estate Investing Education

Very narrow areas of expertise can be very productive. Develop

your own profile. Develop your own niche.

Leigh Steinberg

While at first it may seem important that you learn everything you can about real estate investing, in reality,

it is best to focus on two things: an investment vehicle and a strategy for using that vehicle. This chapter is

going to introduce you to some of the most popular investment vehicles, as well as the most common

strategies for moving forward.

In This Chapter We'll Cover

Why Real Estate is Like a Box of Chocolates

Choosing Your Niche

Choose Your Real Estate Investing Strategies

Buy and Hold

Flipping

Wholesaling

Moving On

23 | Real Estate Investments

Real Estate Investments are Like a Box of Chocolates

Have you ever received a box of chocolates as a gift over the holidays? There are always so many choices,

and sometimes, you need to take a little bite of each one to figure out what exactly you're going to find

inside. In a way, learning how to invest in real estate is like that box of chocolates. There are dozens (if not

hundreds) of different ways to make money as a real estate investor, and it's up to you to choose the niche

you want to get into.

You might absolutely love some niches and

strategies, while others might make you shudder.

However, unlike that box of chocolates, as an

investor, you are able to get a full view of the many

different choices available to you, and you can then

choose the one(s) that you enjoy the most. Best of

all, you don't need to choose them all. Learning

how to successfully invest in real estate is about

choosing one niche and becoming a master of it.

This chapter is going to open up that box of

chocolates for you to sample and let you see some

of the most common niches you can get into when

investing in real estate.

Remember: Once you know the niche you want to get started with, you will be able to narrow down your

focus, become an expert, network with individuals within that niche, and begin building wealth by taking

action and executing a plan of action.

Choosing Your Real Estate Investment Niche

The following list includes the most common property types that you are likely to deal with as a real estate

investor. Each of these has many subsets as well, but remember, you don't need to know them all. This is

merely a list to help you get started understanding what options are available from a 20,000 foot view.

Raw Land

24 | Real Estate Investments

Raw land is nothing more than basic earth. Land on its own can be improved to add value, and it can be

leased or rented to create cash flow. Land can also be subdivided and sold for profit. Some investors choose

to buy raw land with hopes (or plans) that someday the land will become much more valuable due to

external developments like the construction of a freeway or from a development being built nearby.

For More Information on Raw Land, see:

•

Residential Land Development – Part 1

•

Developing Real Estate: How to Price Land for Profit

Single-Family Homes

Perhaps the most common investment for most first time investors is the single family home. Single family homes are

relatively easy to rent, easy to sell, and easy to finance. That said, in many areas, the rents derived from SFRs (single

family rentals) won't be enough to provide positive cash flow.

For More Information on Single Family Houses, see:

•

Secrets of Single Family Rentals

25 | Real Estate Investments

Duplex/Triplex/Quads

Small multifamily properties (2-4 units) combine the financing and easy purchasing benefits of a single family

home. Bought properly, these can cashflow quite well, and there is often less competition than what you'd

run across bidding on single family homes. Best of all, these properties can serve as both a solid investment

as well as a personal residence for the smart investor. Another perk of the small multifamily property is the

ability to take advantage of "economies of scale," as only one loan is needed to secure the 2, 3, or 4 units in

the property. One of the things that makes these investments so appealing is that most banks look at small

multifamily properties with four units or less with the same guidelines as a single family house, which can

make qualifying for a loan much easier.

For More Information on Duplexes, Triplexes, and Quads see:

•

Small Multifamily Properties = Big Profits

•

Financing a Fourplex Real Estate Investment Property

•

New Investor Strategy: How to Buy Your First Multi-Family Investment Property & Live Rent Free

Small Apartments

Small apartment buildings are made up of between 5 and 50 units.

Though the line between small and large apartments is not set in stone,

most investors typically draw the line between small and large apartment

buildings at around 50 units. These properties can be more difficult to

finance than single family homes or 2-4 unit properties, as they rely on

commercial lending standards instead of residential ones. That said, these

properties often provide significant cash flow for the investor who can

deal with the more management-intense nature of the properties.

Additionally, competition is generally seen on a lower scale for this

property type, as they are too small for large, professional REITs to invest

in (see below), but too large for most novice real estate investors.

Instead of being priced based on comps, the value of these properties are based on the income they bring in.

This creates a huge opportunity for adding value by increasing rent, decreasing expenses, and managing

26 | Real Estate Investments

effectively. These properties are a great place to utilize on-site managers who manage and perform

maintenance in exchange for free or decreased rent.

For More Information on Small Apartments, see:

•

How to Find the Best Commercial Apartment Deals

Large Apartments

This class of property -- Large Apartments -- refers to the large complexes

you might see all across the country that often include pools, work-out

rooms, full time staff, and high advertising budgets. These properties can

cost many millions of dollars to purchase, but can produce stable returns

with minimal personal involvement. Many large apartments are owned by

"syndications," which are small groups of investors who pool their resources.

For More Information on Large Apartments, see:

•

Anatomy of the Grand Slam: How I Made $800,000 on One Flip

REITs

REIT stands for a Real Estate Investment Trust. In

the most simplistic definition, a REIT is to a real

estate property as a mutual fund is to a stock. A

large number of individuals pool their funds

together, forming a REIT, and allow the REIT to

purchase large real estate investments, such as

shopping malls, large apartment complexes,

skyscrapers, or bulk amounts of single family

homes. The REIT then distributes profits to individual investors. This is one of the most hands-off approach

to investing in Real Estate, but do not expect the returns found in hands-on investing. You can buy shares in a

REIT via your stock account, and they often have a relatively high dividend payment.

For More Information on REITs, see:

•

Is Now a Good Time to Invest in a REIT?

27 | Real Estate Investments

Commercial

Commercial investments can vary dramatically in size, style, and purpose, but ultimately involve a property

that is leased to a business. Some commercial investors rent buildings to small local businesses, while others

rent large spaces to supermarkets or big box megastores. While commercial properties often provide good

cash flow and consistent payments, they also may carry with them much longer holding periods during times

of vacancies; commercial property can often sit empty for many months or years. Unless you are starting

from a very solid financial position, investing in commercial real estate is not recommended for beginners.

For More Information on Commercial Investing, see:

•

BP Podcast 004: Commercial Real Estate Investing With Frank Gallinelli

•

3 Things You Need to Know to Invest in Commercial Real Estate

•

Commercial Real Estate Listing Tools, News & Discussions

Mobile Homes

You can start investing in mobile homes with little money out of pocket.

Whether it’s a home in a mobile home park or on its own land, many of the

strategies used in other types of real estate investing can be applied to

mobile homes.

For More Information on Mobile Homes, see:

•

Mobile Home Investing with Creative Strategies

•

Mobile Home Investing: AKA The Moolah Maker

28 | Real Estate Investments

Tax Liens

When homeowners don't pay their taxes, the government (local,

state, or federal) can foreclose and resell the property to investors

for the amount of taxes owed. This can often mean incredibly

inexpensive properties, but be sure to do your due diligence and

don't just jump into this kind of investing unprepared. Tax lien sales

are complicated transactions that require research, knowledge, and

experience.

For More Information on Tax Liens, see:

•

Tax Liens: What They Are and How to Use Them In Your Business

Notes

Investing in notes involves the buying and selling of paper

mortgages. When a home is purchased with a loan, a “note” is

created explaining the terms of the contract. For example, an

apartment owner decides to sell his property for one million

dollars. He offers to carry the full note (thus allowing the new

buyer to avoid using a bank loan), and the new buyer will make

payments of 8% per year for thirty years until the full one million

dollars is paid off.

If that owner decided they no longer wanted to be involved, he

might choose to sell that mortgage to a “note buyer." Just like any

other real estate investment, many times a note will be sold for a discount when the seller is motivated to

sell. A note buyer will then begin collecting the monthly mortgage payments and will have the right to keep

the note or sell it again in the future.

For More Information on Investing in Notes, see:

•

Cash Flow Notes: 5 Steps to Investing Through "Lien Landlording"

A Summary of Your Real Estate Investment Niche Choices

We've just outlined ten different investment niches, or vehicles, that you can invest in to take you on your

journey through real estate investing. When starting out, it's helpful to simply pick one (or, at most, two)

niches to focus on and become a pro at that niche. You can always expand later as you get more experience

and knowledge.

While you can use any of these investment vehicles in your career, you must next learn an investment

strategy that you can apply to that niche. The next section will look at several different strategies that

investors use to make money with the various niches already covered.

29 | Real Estate Investments

For More Information on Choosing Your Niche, See:

• Finding Your Niche in Real Estate

• Real Estate Investing principles Using Focus to Build a Solid Business Foundation

• Top 100 Ways to Make Money in Real Estate

•

BP Podcast 047: Apartment Complexes, NNN Leases, and Commercial Real Estate with Joel Owens

•

BP Podcast 052: Buying Apartment Complexes, Raising Millions, and Building a Profitable Business with Ken

McElroy

•

BP Podcast 004: Commercial Real Estate Investing With Frank Gallinelli

•

BP Podcast 056: Syndicating Deals, Investing without Tenants, and Tax Liens with Ankit Duggal

Choose Your Real Estate Investing Strategies

The section above looked at a number of different investment vehicles that you can use to invest in real

estate. However, when learning how to invest in real estate, it is not enough to simply know what these

property niches are. Instead, as an investor you will use a variety of strategies when dealing with these

investment niches to produce wealth. The section below explores three of the most common strategies that

you can use to make money with these vehicles.

Buy & Hold

Perhaps the most common form of investing, the "buy and hold strategy" involves

purchasing a property and renting it out for an extended period of time. It's

probably the most simple and purest form of real estate investing that there is.

Essentially, a "buy and hold investor" seeks to create wealth by renting the

property out and either collecting monthly cash flow or simply holding the

property until it can be sold for a gain in the future. Among the advantages of this

strategy is that during the time that you hold the property and rent it out, the

mortgage is paid down each and every month, decreasing your principal balance

and increasing your equity in the property.

One of the most important things for a new buy and hold investor to understand is how to evaluate deals

and opportunities. By far the most common mistake that we see new investors make with this strategy is

buying bad deals because they simply don't understand property evaluation. Other common problems

include underestimating expenses, making bad decisions on tenant selection, and failing to manage properly.

These mistakes can all be avoided, however, if you simply learn the business; jumping in without proper

education can be extremely costly financially and sometimes, legally.

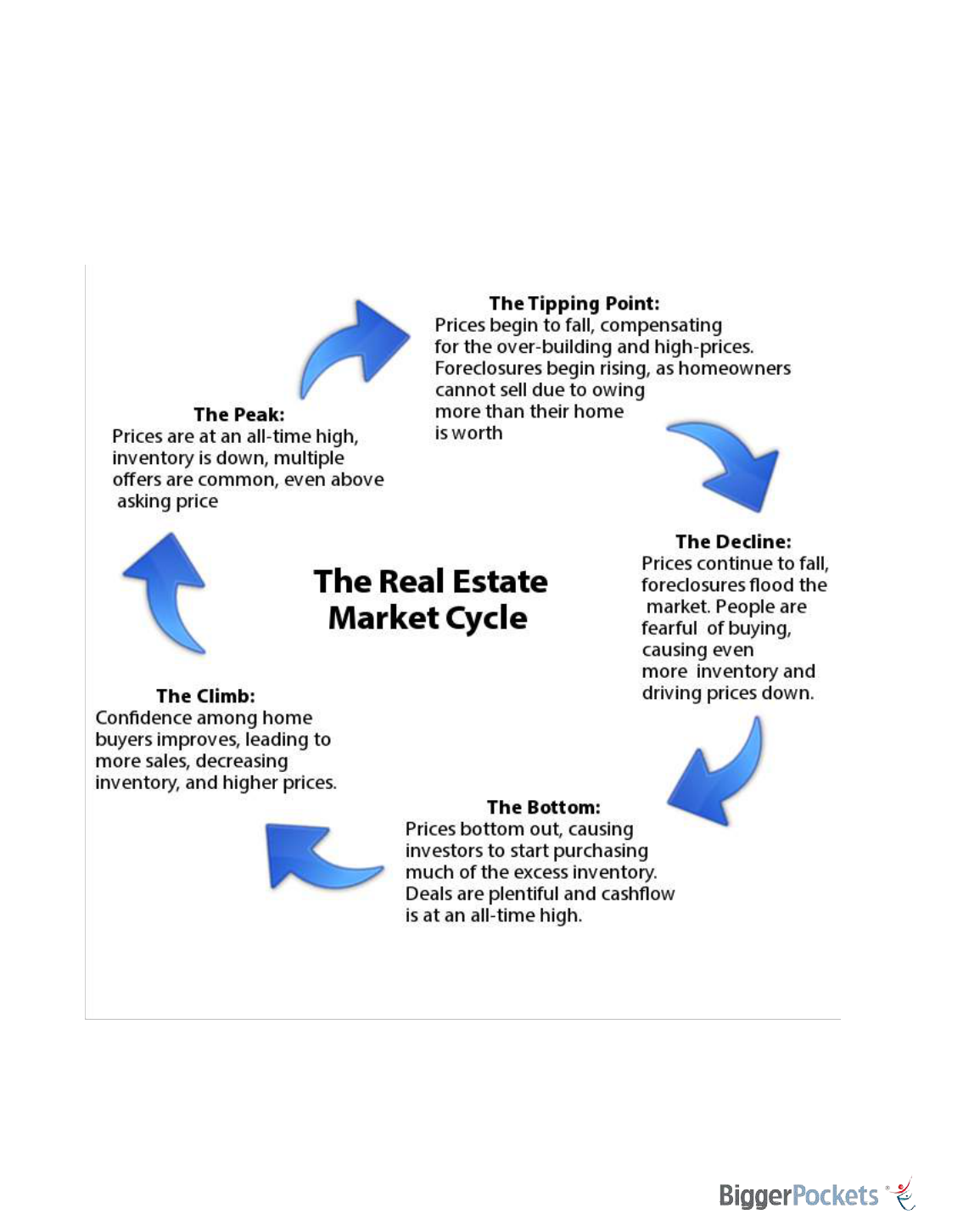

To properly carry out the buy and hold strategy, an investor should learn how to properly identify the ebbs

and flows of the market that a property is located in. Ultimately, when they perceive the market and the

properties they are interested in to be at a low point (prices low, inventory high), the buy and hold investor

30 | Real Estate Investments

seeks to purchase properites. When the market becomes over-heated, an experienced buy and hold investor

will usually stop buying until they see things settle back down. During these slow periods, they may sell or

simply continue to hold their properties. Some buy and hold investors never sell a property, choosing instead

to pay the mortgage off and live on the cash flow or may ultimately sell using "Seller Financing" (see chapter

8 for more on exit strategies).

Check out the following image for a simplified example of how the real estate

market cycle works:

Ultimately, there is much more to buy and hold than meets the eye, but if you can learn how to evaluate and

buy good deals, find quality tenants, and manage properly, you're going to be on your path to running a

successful business.

31 | Real Estate Investments

For More Information on the Buy and Hold Strategy, See:

•

3 Key Factors in Buy and Hold Real Estate Investing

•

What Is Hybrid Real Estate Investing

•

Back to Basics on Buy and Hold

•

The Return Of the Real Estate Buy and Hold Strategy

Flipping Real Estate

One of the most popular tactics for making money in real estate,

due largely to the numerous shows on cable TV that promote it, is

flipping houses. House flipping is the practice of buying a piece of

real estate at a discounted price, improving it in some way, and

then selling it for a financial gain. In reality, the flipping model is

quite similar to the "buy low, sell high" model of most retail

businesses.

The most popular type of property to flip is the single family home. Following a rule of thumb known as the

70% rule, an experienced house flipper will buy a home for 70% of its current value less any rehab costs. For

example: Home A should be worth $100,000 if it were in good condition, but it needs $20,000 worth of work.

A typical house flipper will purchase the home for $50,000 ($100,000 x 70% - $20,000) and seek to sell it for

the full $100,000 when completed. This is simply a rule of thumb, and actual numbers must be verified and

adjusted to ensure a successful and profitable flip.

Check out the FREE BiggerPockets 70% Rule Calculator to quickly

check if a deal is a good one using this rule of thumb.

One of the key aspects in flipping a house is speed. A house flipper will attempt to buy, rehab and sell the

property as quickly as possible to ensure maximum profitability and to avoid many months of expensive

carrying costs. These carrying costs include monthly bills such as financing charges, property taxes, condo

fees (if applicable), utilities and any other maintenance bills required to keep the house in good financial

standing.

Flipping is not a "passive" activity, but instead is just like an active day job. When an investor stops flipping,

they stop making money until they begin flipping again. Many investors choose to use flipping to fund their

day-to-day bills, as well as provide financial support for other, more passive investments.

32 | Real Estate Investments

If flipping is an activity you want to get more into, we'd highly recommend that you check out the

BiggerPockets newly released book, "The Book on Flipping Houses," along with the free bonus book,

"The Book on Estimating Rehab Costs." These books can be fundamental in helping you learn how to

start a profitable house flipping business. To learn more about these valuable resources, click here.

For more information on flipping, please see:

• Simple Things When Flipping Houses

• 9 Steps to Flipping Houses (Infographic)

• Fixing and Flipping: A Business or a Job?

• Six House Flipping Tips

•

BP Radio Podcast 001: Building a Successful House Flipping Business and Losing Millions with Marty

Boardman

•

BP Podcast 010 : Flipping Houses 101 with J Scott

•

BP Podcast 018 : Flipping, Marketing, and Wholesaling with Danny Johnson

•

BP Podcast 022 – Building a Marketing Machine, Spec Houses, Flipping & Wholesaling with Tucker Merrihew

•

BP Podcast 023: Flipping While Working a Job, Partnerships, and Military Investing with James Vermillion

•

BP Podcast 024: House Flipping and Deal Analysis with Michael LaCava

•

BP Podcast 027: Fix and Flipping, Wholesaling, Marketing, and More with Jason and Katherine Grote

•

BP Podcast 032: Luxury House Flipping, Finding Deals, and Discovering Your Niche with Will Barnard

•

BP Podcast 039: Dirt Cheap Land Flipping and Reaching Motivated Sellers with Seth Williams

•

BP Podcast 041: How to Profit Through Long Term Flipping and Lease Options with Douglas Larson

•

BP Podcast 044: Creating Systems to Flip Houses While Still Employed with Michael Woodward

•

BP Podcast 050: Getting Started and No Money Down House Flipping with Mike Simmons

•

BP Podcast 058: Flipping and Wholesaling Homes While Working Full Time with Justin Silverio

33 | Real Estate Investments

Don't overpay for your next real estate flip!

Use the BiggerPockets Fix & Flip Analysis & Reporting Tool to easily weed

out bad deals & estimate your next big profit.

Wholesaling Real Estate

Wholesaling is the process of finding great real estate deals,

writing a contract to acquire the deal, and then selling the

contract to another buyer. Generally, a wholesaler never actually

owns the piece of property they are selling; instead, a wholesaler

simply finds great deals using a variety of marketing strategies

(see chapter 7), puts them under contract, and sells that contract

to another for an "assignment fee." This fee is typically between

$500 and $5,000 on average -- or more depending on the size of

the deal. Essentially, the wholesaler is a middleman who is paid

for finding deals.

Some wholesalers sell their contracts to retail buyers, but most

sell their contracts to other investors (often house flippers) who

are typically "cash buyers." When dealing with these cash buyers, a wholesaler can often get paid within days

or weeks and can build solid connections in the real estate community.

Many investors choose to begin with wholesaling due to its reputation of being an easy strategy and one with

low start up costs when first beginning. Because the property is never actually owned by the wholesaler,

there are no rehab costs, loan fees, contractors, tenants, banks, or other complications. Wholesaling is the

most popular strategy taught by real estate gurus and often receives the most attention as a result, though it

is not as easy to become a successful wholesaler as they make it sound.

Wholesalers must continually seek out the best deals in order to have

inventory to sell to others and must have a well designed marketing funnel to

continually attract these leads. Wholesalers also must continually seek out

buyers for the deals they acquire. While promoted as a strategy that anyone

can do -- even someone with ZERO money -- you ultimately do need to have

financial resources to build your marketing funnel. That said, those who

persist in growing their wholesaling skills often find great success and a good

source of income while they grow their knowledge of other, more profitable

strategies.

34 | Real Estate Investments

For more information on Wholesaling, please see:

•

Don’t Start Wholesaling Until You Read This: Wholesale Advice from a Fix and Flipper

•

How to Start Wholesaling: Getting Past The Education and Into the Field

•

The Basics of Wholesaling For Beginners

•

Wholesaling Real Estate Basics

•

You Have a Buyer's List... Now What?

•

The Flippers Best Friend: The Wholesaler

•

How to Evaluate Wholesale Real Estate Deals

Moving On

After reading this chapter, you should now have a clearer understanding of the many different real estate

niches and strategies that you can use to build wealth in real estate. Don't worry if you don't know exactly

which one you want to pursue yet -- this is simply the beginning. Learning how to invest in real estate can

take time. As you move forward through this guide, you will gain a better understanding of the kind of

investing you want to engage in. Throughout this guide, we will give you numerous tips and sources you can

use to narrow down your plan further. As mentioned earlier, be sure to check out the

BiggerPockets

Forums

, where you can ask questions, and, of course, search the site to find any more help that you might

need.

You are probably excited to get started making money in real estate. Before you do, however, there is one

major step that will make all the difference between early success and failure: building your business plan.

Chapter 4 will explore this topic.

35 | Real Estate Investments

"Do you wish to be great? Then begin by being. Do you desire to

construct a vast and lofty fabric? Think first about the

foundations of humility. The higher your structure is to be, the

deeper must be its foundation."

Saint Augustine

No great building is made without careful planning before ground is broken.

This plan serves as the map for the development of the structure, without

which the building just won't come together. In the same way, carefully

crafting your real estate business plan is an integral part of your journey.

This chapter will focus on the options you have in building that plan and will

prepare you for your entrance and long-term success in real estate

investing.

This chapter includes:

Creating a Business Plan

Assembling Your Team

Partnerships

Business Entity Structuring

36 | Creating Your Real Estate Investing Business Plan

Creating a Real Estate Investing Business Plan

If you were to get in your car and take a road

trip across the country to an area you have

never been before – would you just trust your

gut and start traveling in the general direction

you want to get to? Most likely, you'd take with

you a road map (or G.P.S. or smartphone, of

course).

The reason we use road maps is because

oftentimes the road is unpredictable, and the

right road may seem to lead to the wrong place.

Other times, the wrong road might seem to

point directly toward your destination. Road maps are created to show the easiest route, the pitfalls you

want to avoid, and special things to see along the way.

The same principle applies for your journey into real estate investing. This section is going to discuss building

the road map that you'll follow on your journey. In real estate, we call this a “business plan.”

What Your Real Estate Business Plan Should Include

Mission Statement - When people ask you what you do, what do

you tell them? This mission statement should clearly define your

purpose and should include the benefits your business provides. Do

your research and come up with a solid mission statement. This is

the “why” in your road trip.

Goals - Where do you want to go? What do you want real estate to

help you to achieve? If your goal is to make $5,000 per month in

passive income – write that down. If you goal is to flip four homes

per month – write that down. These goals may change over time,

affecting the rest of your business plan – and that's okay. Make sure

to put down both short and long term goals. By setting smaller,

more achievable goals, you'll give yourself something to always look

forward to accomplishing – this will help you stay motivated.

Strategy - There are hundreds of ways to make money in real estate – but you don't need hundreds. You

simply need to pick one strategy and become a master of it. That strategy (vehicle), if dependable, will carry

you through to your destination (your goals). If you are choosing to flip homes to generate cash in order to

save up enough to quit your job – write that down. If you are looking to build passive income from small

multifamily properties for your retirement – write that down. Don't worry if you don't understand or know

how you're going to accomplish everything in the plan. Remember, your business plan can and will change in

time, and as you learn, you'll fill the plan out with more details.

37 | Creating Your Real Estate Investing Business Plan

Time Frame - What is your time frame to reach your goal? Be realistic, but don't

be afraid to reach, either. Do you want to retire in ten years? Are you planning

on quitting your job next month? Document your timeline here. You can do this

in accordance with your goals, as mentioned above.

Market - Define your market. What kind of property will you be looking for?

Low income? High Income? Commercial areas? As a beginner, choose an area

you feel most comfortable with. Most new investors should plan on investing

within a short driving distance to your home, rather than investing long distance

(unless your location makes it impossible). Doing this will help you to become an expert in that area, which