Mortgage Secrets For Real Estate Investors

by

Susan Lassiter-Lyons

How to BEAT MORTGAGE LENDERS

at their own game and INCREASE YOUR PROFIT

on every real estate investment.

Mortgage SecretS

for Real Estate Investors

is book was written with the intention of providing information on the subject matter contained herein. However, the

author and publisher are not engaged in rendering legal, investment or tax advice or services through this publication. If legal

or other expert services are required, the services of a competent professional should be sought.

is book was designed to give correct and helpful information, but there may be typographical errors or mistakes in content.

Care should be taken to use this book as a general guide to real estate investment and finance information and not as the

ultimate source of this type of information. In addition, the information in this book is only current up to the date of

publication.

e purpose of the opinions and the information contained in this book is to educate and entertain the reader. e publisher

and author of this book shall not have responsibility to any person or other legal entity in regard to any loss or damage caused

or alleged to be caused either directly or indirectly by the information or the use of the information contained in this book.

IMPORTANT COPYRIGHT & LEGAL NOTICE:

You Do NOT Have the right to reprint, resell, auction or re-distribute the Mortgage Secrets for Real Estate Investors e-book.

You May NOT give away, sell, share, or circulate the Mortgage Secrets for Real Estate Investors e-book or any of its content in any form.

e copy of Mortgage Secrets for Real Estate Investors you have purchased is for your own personal use. e e-book is fully printable and one

printed copy may be made for your own personal use. You are also welcome to copy the e-book to a CD-Rom, zip disc or other storage media

for backup for your own personal use.

If you have received a copy of the Mortgage Secrets for Real Estate Investors e-book without purchasing it from the official Mortgage Secrets for

Real Estate Investors website www.mortgagesecretsbook.com, then you have an illegal, pirated copy in violation of international copyright law.

Visit the official Mortgage Secrets for Real Estate Investors website to purchase and register your own personal copy. All e-books are coded and

traceable to the original purchaser to prosecute fraud. Registration entitles the purchaser to all future e-book updates and a lifetime subscription

to the monthly newsletter.

Electronic books, also known as e-books, are protected worldwide under international copyright and intellectual property law, the same as

printed books, recorded material and other literary works. Under Copyright law, “Literary Work” includes “computer”, “computer program”,

“software”, and all related materials sold online, including electronic books (e-books), and adobe acrobat PDF files.

Copyright infringement, trademark infringement and theft of intellectual property are serious crimes. Copyright infringement is a felony and

civil fines for conviction of such infringement now begin at $150,000 per infringement. Criminal fines for infringement begin at $250,000

and may also result in up to five years in prison.

Please help stop Internet crime by reporting illegal activity to: info@mortgagesecretsbook.com

Mortgage Secrets for Real Estate Investors is a trademark of Lassiter Mortgage Group, LLC, Copyright 2009, 4

nd

Edition.

ISBN-13: 978-1-4243-2852-9

ALL RIGHTS RESERVED: No part of Mortgage Secrets for Real Estate Investors may be reproduced or transmitted in any form whatsoever,

electronic or mechanical, including photocopying, recording, or by any informational storage or

retrieval system, without expressed,

written and signed permission from the author (with the exception of brief quotations as used in reviews or discussion groups,

with attribution to the author and source).

i

Dedication

Dorothy H. Lassiter

1910 – 1997

My Grandmother and Teacher

ank you for the love, the lessons and the laughter.

iii

Foreword

e mortgage business is a complicated and ever-changing industry. It is important that you understand

how the mortgage market works and how the lenders make their profit. In doing so, you will gain an

appreciation of loan programs and why certain loans are offered by certain lenders.

Investors use mortgage loans to increase their leverage. e more money an investor can borrow, the

more he can leverage his investment. Rarely do investors use all cash to purchase properties, and when

they do, it is on a short–term basis. ey usually refinance the property to get their cash back or sell

the property for cash.

e challenge is that loans for investors are treated as high–risk by lenders, as compared to non-investor

(owner-occupied properties) loans. Lenders often look at leveraged investments as risky, and are less willing

to loan money to investors. Lenders assume that the less of your own money you have invested, the more

likely you will walk away from a bad property. e goal of the investor thus is to put forth as little cash as

possible, pay the least amount in loan costs and interest, while keeping personal risk at a minimum.

As an investor, getting a mortgage may seem like a straightforward process on the surface. But as Susan

and I well know it is the financing that can make or break the profitability of any real estate investment.

It pays to do business with the experts and it pays to educate yourself about the process, with its many

pitfalls and challenges, before you ever make offers on properties.

Real estate investing will make you a lot of money if you learn the techniques and apply yourself. e

bottom line is that education will help you avoid mistakes and learn new ideas. Read books, go to

seminars and learn from other investors. Your best investment is in yourself.

I regularly refer Colorado investors to Susan when they have challenging loan scenarios so I know the

information you’ll learn from this book will serve you well in the future.

WILLIAM BRONCHICK

William Bronchick, CEO of Legalwiz Publications, is a Nationally-known attorney, author,

entrepreneur and speaker. Mr. Bronchick has been practicing law and real estate since 1990,

having been involved in over 1000 transactions. He has trained countless people all over the

Country to become financially successful. His best-selling book, “Flipping Properties,” was named

one of the ten best real estate books of the year by the Chicago Tribune. William Bronchick is also

the author of the highly acclaimed books, “Financing Secrets of a Millionaire Real Estate Investor”

and “Wealth Protection Secrets of a Millionaire Real Estate Investor.”

William Bronchick has served as President of the Colorado Association of Real Estate Investors since 1994.

v

Table of Contents

Introduction 1

e Problem with ose Investment Gurus 2

Industry Secrets 2

e Secret Agencies 3

Mortgage Rate Secrets—why do they go up and down? 4

Your Secret Ratio 6

Special Secrets for the Self Employed Investor 7

Credit Score Secrets 7

Loan to Value Secrets 8

Condo Secrets 11

Rural Property Secrets 12

Mobile Home Secrets 13

Loan Application Secrets 13

Pre-Approval Secrets 15

Reserve Secrets 16

Loan Product Secrets 17

e Secret of Determining Your Interest Rate 18

Amortization Secrets 19

Secret Loan Features for Investors 20

Hard Money Loan Secrets 22

Rate Secrets 23

e Biggest Secret of All—Yield Spread Premium 24

Seller Concession Secrets 26

C S—Seller Paid Origination 27

Interest Rate Buy Down Secrets 27

Rate Lock Secrets 28

Secrets of the Good Faith Estimate 29

Appraisal Secrets—It’s All in the Approach 31

Secrets of As-Is vs. Subject-To 31

No Appraisal Loan Secrets 32

Deferred Maintenance—is SHOULD be a Secret! 32

Loan Processing Secrets 33

Loan Underwriting Secrets 36

Title Insurance Secrets 38

Cash Back At Closing Secrets 39

vi

Double Close Secrets 39

Cross Collateralization Secrets 40

Secret to Financing Foreclosures 41

e Secret to Buying in the Name of Your LLC 41

Non Recourse Loan Secrets 42

100% Loan Secrets 43

e MLS Listed Refinance Secret 43

e Vacant Property Refinance Secret 44

Hazard Insurance Secrets 44

Case Studies 45

In Closing 51

About e Author 53

Appendices 54

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

1

Introduction

Congratulations! You’re An Investor

Congratulations! You have decided to become a real estate investor—or you already are one! It’s an

exciting profession and hobby. I first began investing in real estate back in 1994. My friends from work

and I went to a seminar about investing in tax liens and, convinced we would soon be millionaires, set

about researching the tax lien auctions that were happening in the counties of Colorado.

We formed a limited liability company and called ourselves e Lien Lords. Pretty clever, huh? When we

got to the auction we had a pooled sum of $1000 and we ended up winning four tax liens. Tax liens back

then paid close to 16% upon redemption so we made a few bucks when three of the liens redeemed within

a year. e 4

th

lien, to this day, has never redeemed. is was a dinky $17 lien on a piece of vacant land in

an area of Colorado called Strasburg. I figure if urban sprawl ever really sprawls then we will apply for the

treasurer’s deed and make a profit when we sell the land.

My next foray into investing was after attending a seminar on lease options. I learned how to structure

the sandwich lease option. I managed to get two properties under contract but then could never re-

lease option them.

Never one to be daunted, I then attended a seminar on how to invest in apartment buildings. is time,

something happened—I got it! I actually understood the concepts and realized that multi-units were

the strategy for me. I immediately bought a triplex that needed some work for $199,000. I put $16,000

into fixing it up and today it cash flows and is worth $315,000. Finally, after all those seminars, home

study courses, mentorships and books read, I was finally a REAL real estate investor. is continues to

be my personal focus today. I look each week for bank owned or distressed 3 and 4 unit buildings and

have my realtor make offers.

However, as adept as I felt I was at the investing side of things, the one big gaping hole in my knowledge

that I couldn’t really seem to find any information on, was the financing piece of the puzzle. I couldn’t

figure out why there were so many rules that made no sense. For example, when I went to my bank

and told them I wanted a loan for my triplex that gave me 100% of the purchase price plus rolled in

all of the closing costs and repair costs, they actually laughed at me. LAUGHED at me right there in

the office.

Again, never one to cave to a challenge, I went to work for a mortgage company. I figured it was a

decent way to make a living plus gain insight into the lending process for investment properties. Turns

out my gamble paid off. I started in a department called Secondary Marketing where I learned the

mortgage industry from the top down. I learned how Wall Street buys pools of mortgages and I learned

all about mortgage backed securities. I also learned how to price loans and how current events and

economic indicators drive interest rates.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

2

en I went to work part-time on the side as a loan originator for a local broker to generate some

real money for my knowledge. When my first commission check on one loan turned out to be bigger

than my pay check for two entire weeks at the mortgage company, I quit on the spot to originate full

time. After an appropriate number of months, I became a broker and set up my own shop arranging

residential and commercial financing for real estate investors and that is what I continue to do today.

is book is my attempt to give you the benefit of the education I have received through lessons

learned and hard knocks. Every mistake I have made and every crazy scenario I’ve encountered

through my clients and associates is in this book. You now are privy to more than 6 years of insider

mortgage knowledge. Use it wisely!

e Problem with ose Investment Gurus

In my previous chapter I mentioned a few real state investment seminars that I have been to. It seems

like there is a new one every week and a new guru to go with it. Now I am all for education and

benefiting from knowledge that someone else has gained and is willing to share with me for a price,

but I feel that some gurus are lacking in real world application. e stuff always sounds better in theory

than it plays out in real life. Like the cash back at closing thing that so many people tout. Carleton

Sheets says there are 10 ways (or more) to get cash back at closing. I know for a fact that many of them

can never be accomplished using a conventional lender to finance your loan. You have to use hard

money and pay almost three times as much for it.

Sometimes the tricks that they share with you just do not fly in the real world. is book will never be

guilty of that. is is because I have spent a great deal of time rescuing people that are trying to do it

according to some guru. Creatively finding ways to accomplish the theory in the real world is essentially

my specialty. So, do not fear! is will not be another one of those situations where you could be rich

if only the strategies actually worked. ese strategies DO work and if you follow my advice, you will

discover ways to get around some of the messes that other gurus can get you in.

Industry Secrets

A

. T ’

’ . M ,

.

Back before 1934, insurance companies were the only entities providing financing for homes. After

1934, the Federal Housing Authority (FHA) was established to try to stimulate homeownership and

they established mortgages with down payments as low as 50% and amortized over 5-7 years with

balloon payments at the end of the term. Yikes!

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

3

Over time, the down payment requirements were lowered and many new types of loan programs were

developed and marketed to make home ownership appealing and affordable to the masses.

Today we have literally hundreds of entities offering hundreds of different mortgages or loan programs.

Ultimately most mortgages are securitized and sold off in bulk to agencies such as Fannie Mae and

Freddie Mac through the Secondary Mortgage Market which is just a market in which existing

mortgages and mortgage-backed securities are traded. Most lenders will either sell their loans outright

for cash or swap them for mortgage-backed securities such as Participation Certificates which they can

hang on to or sell to dealers for cash.

e Secret Agencies

A

, -

. M

U.S. G. E

F M (FNMA), F M (FHLMC), FHA

G M (GNMA). A

. T . I

“ ” -. N-

.

If a loan is outside of Fannie Mae’s standard guidelines, the agencies won’t buy it and the lender either

has to service the loan themselves while holding it in their own portfolio or find a whole loan buyer that

will buy it from them. Most whole loan buyers are Wall Street companies such as Bear Stearns, Credit

Suisse, Lehman, Goldman Sachs, etc.

Lenders pool whole loans together with credit enhancements to create whole loan collateralized

mortgage obligations or CMOs. Credit enhancements are designed to make the loans more palatable

and to ensure investors receive timely interest payments. is, my friend, is why there are so many rules

about mortgages for investment properties. Because mortgages on investment properties are the riskiest

mortgages out there, the originators have to have these crazy rules to make them less risky and more

attractive to the end buyer.

In a nutshell, this is why EVERY lender will do a 20% down 30 year fixed owner occupied mortgage

but only a few will do a higher loan-to-value adjustable rate mortgage for an investor. e 30 year

is an easy sell but they have a harder time unloading the riskier investor adjustable rate loan.

Mortgage lenders or originators also have the option of selling the loan and the servicing rights or just

the loan or just the servicing. ere are lots of different ways to profit from the sale of a mortgage.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

4

is book isn’t meant to be a course in secondary marketing and mortgage securitization (thank

goodness), I only bring it up to give you an idea of what is going on in the background and who is

really making the rules.

Mortgage Rate Secrets—why do they go up and down?

To understand why mortgage rates change, we must first ask the more general question, “Why do interest

rates change?” It is important to realize that there is not one interest rate, but many interest rates!

Prime rate: e rate offered to a bank’s best customers.

Treasury bill rates: Treasury bills are short-term debt instruments used by the U.S. Government

to finance their debt. Commonly called T-bills they come in denominations of 3 months, 6

months and 1 year. Each treasury bill has a corresponding interest rate (i.e. 3-month T-bill rate,

1-year T-bill rate).

Treasury Notes: Intermediate-term debt instruments used by the U.S. Government to finance

their debt. ey come in denominations of 2 years, 5 years and 10 years.

Treasury Bonds: Long-debt instruments used by the U.S. Government to finance its debt.

Treasury bonds come in 30-year denominations.

Federal Funds Rate: Rates banks charge each other for overnight loans.

Federal Discount Rate: Rate New York Fed charges to member banks.

Libor: London Interbank Offered Rates. Average London Eurodollar rates.

6 month CD rate: e average rate that you get when you invest in a 6-month CD.

11th District Cost of Funds: Rate determined by averaging a composite of other rates.

Fannie Mae-Backed Security rates: Fannie Mae pools large quantities of mortgages, creates

securities with them, and sells them as Fannie Mae-backed securities. e rates on these securities

influence mortgage rates very strongly.

Ginnie Mae-Backed Security rates: Ginnie Mae pools large quantities of mortgages, secures

them and sells them as Ginnie Mae-backed securities. e rates on these securities influence

mortgage rates on FHA and VA loans.

Interest rate movements are based on the simple concept of supply and demand. If the demand for credit

(loans) increases, so do interest rates. is is because there are more buyers, so sellers can command a

better price, i.e. higher rates. If the demand for credit reduces, then so do interest rates. is is because

there are more sellers than buyers, so buyers can command a lower better price, i.e. lower rates. When

the economy is expanding there is a higher demand for credit, so rates move higher, whereas when the

economy is slowing the demand for credit decreases and so do interest rates.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

5

is leads to a fundamental concept:

Bad news (a slowing economy) is good news for interest rates (lower rates).

Good news (a growing economy) is bad news for interest rates (higher rates). A major factor

driving interest rates is inflation. Higher inflation is associated with a growing economy. When

the economy grows too strongly, the Federal Reserve increases interest rates to slow the economy

down and reduce inflation. Inflation results from prices of goods and services increasing. When

the economy is strong, there is more demand for goods and services, so the producers of those

goods and services can increase prices. A strong economy therefore results in higher real estate

prices, higher rents on apartments and higher mortgage rates.

Mortgage rates tend to move in the same direction as interest rates. However, actual mortgage rates

are also based on supply and demand for mortgages. e supply/demand equation for mortgage rates

may be different from the supply/demand equation for interest rates. is might sometimes result in

mortgage rates moving differently from other rates. For example, one lender may be forced to close

additional mortgages to meet a commitment they have made. is results in them offering lower rates

even though interest rates may have moved up!

ere is an inverse relationship between bond prices and bond rates. is can be confusing. When

bond prices move up, interest rates move down and vice versa. is is because bonds tend to have a

fixed price at maturity––typically $1000. If the price of the bond is currently at $900 and there are 10

years left on the bond and if interest rates start moving higher, the price of the bond starts dropping.

e higher interest rates will cause increased accumulation of interest over the next 5 years, such that a

lower price (ie. $880) will result in the same maturity price, i.e. $1000.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

6

Effect of economic data on rates

Number of arrows indicates potential effect on interest rates. 1 arrow=least effect, 5 arrows=max. effect.

Economic EvEnt

EffEct on

intErEst ratEs

significancE of EvEnt

Consumer Price Index (CPI) Rises

Indicates rising inflation

Dollar Rises

Imports cost less; indicates falling inflation

Durable Goods Orders Increase

Indicates expanding economy

Gross National Product Increases

Indicates strong economy

Home Sales Increase

Indicates strong economy

Housing Starts Rise

Indicates strong economy

Industrial Production Rises

Indicates strong economy

Business Inventories Rise

Indicates weak economy

Leading Indicators (LEI) Increase

Indicates strong economy

Personal Income Rises

Indicates rising inflation

Personal Spending Rises

Indicates rising inflation

Producer Price Index Rises

Indicates rising inflation

Retail Sales Increase

Indicates strong economy

Treasury Auction Has High Demand

High demand leads to lower rates

Unemployment Rises

Indicates weak economy

OK! On to the good stuff!

Your Secret Ratio

Debt to income ratio is simply your total debt divided by your gross monthly income. But to get the

real picture, there are two types:

One is your top ratio or your payment to income ratio. is is the total present monthly housing

expense divided by your gross monthly income.

e second ratio is the most important one in terms of mortgage lending and it is known as the

bottom or back ratio. is is calculated by dividing your total monthly debt payments by your

gross monthly income.

Back ratios can go as high as 60% for some sub prime programs. For most investment loan programs,

50% is the max and if you are trying to qualify for an agency loan the max is normally 41%.

1.

2.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

7

Let’s use our plumber again as the example. Let’s say that according to his credit bureau his monthly

debt obligations are as follows:

Countrywide (primary residence mortgage payment) $1500

MBNA VISA $25

Macy’s $25

His total monthly debt payment is $1,550. If we divide that by his income in $5000 then we have a

back ratio or debt ratio of 31%. So far, so good!

Special Secrets for the Self Employed Investor

All investor loans must be fully documented which means if you are self employed they will use your

tax returns to get your income. Make sure you’re showing enough income on your taxes so that your

debt to income ratio will qualify!

Credit Score Secrets

Here we go. is chapter could be a book all on its own. I hope as an investor you realize that this is a

cornerstone of your business and you therefore already have a good understanding of it. I will explain

your credit score as it relates to mortgage lenders and underwriting guidelines.

When you first begin the loan qualification process, your mortgage broker will pull a tri-merge credit

report on you. is means that one single credit report will pull in your scores and reported information

from all three of the main credit bureaus.

e Credit Bureaus

E/FICO

TU/E

E/B

We pull from all three because not all creditors report to all three bureaus. is is just the lender’s way

of making sure they don’t miss anything. Once they get the report, they will use the middle of the three

scores as the credit score on the file.

Let’s say that your scores are:

E/FICO:

TU/E:

E/B:

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

8

We would say that your score is 701 for the purpose of this particular transaction.

If a bureau doesn’t have enough reported information in order to score you then sometimes it won’t

return a score at all. In this case you would just have two scores and the lender will use the lower of the

two for the transaction.

e general rule is that you can qualify for a conforming mortgage with a minimum credit score of

620. Anything below that is considered sub prime and anything 720 and above is considered A+. is

rule is for full doc primary residence loans only. For a stated income investor loan the minimum score

is usually 680. If you are a full doc investor you’ll want to have at least a 660. Again, this is a rule of

thumb so don’t despair if your scores are lower. ere are many lenders out there that will accept much

lower scores on investment loans.

Investors ask me all the time what they can do to improve their credit scores. ere are three types of

debt reported on your credit report—mortgage, installment and revolving. Hopefully you know what a

mortgage debt is! Installment debt is anything that has a fixed monthly payment such as a car payment

and revolving debt is debt that can fluctuate on a monthly basis like a credit card.

Anytime you have a late payment (30 days or more) it will affect your credit in a negative way. However,

if you are having a bad month and you have to choose one obligation NOT to pay, the one that will

affect your score the least is the revolving debt. If you are an investor, you must take care to NEVER

pay a mortgage late. It truly could be the kiss of death. Also, try not to utilize more than 50% of your

total available revolving credit and try to limit the number of times your credit is pulled to no more

than four times per quarter.

To check your three scores online instantly visit the Bonus Offers page at

http://www.mortgagesecretsbook.com/Bonus

Loan to Value Secrets

Mortgages are categorized and priced fundamentally based on the loan to value of the subject property.

e definition of LTV from investopedia.com is:

“A

. T, LTV

, , ,

.”

Calculated as:

Loan to Value Ratio =

Mortgage Amount

Appraised Value of the Property

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

9

Fannie Mae and other agencies require that the borrower have mortgage insurance on a loan that has

an LTV of 80.01% or higher.

I get scenarios all the time where investors have a seller that has agreed to carry back a 2

nd

mortgage of

20% and they want 80% financing for the property. With all conventional lenders this is still going to

be a 100% deal because the CLTV adds up to 100%. You can’t just say it’s an 80% loan even though

that’s all you’re asking of the lender because you are still going to have secondary financing on the

property.

Mortgage insurance coverage is usually charged as a percentage of the loan amount and the higher the

loan to value, the higher the coverage percentage.

Property Type Secrets

Now, just as the underwriter is qualifying you based on your credit history, reserves, etc they are

also qualifying the subject property. Lenders don’t want to write loans on properties that they think

are weird or “outside the guidelines”. e easiest property to finance is obviously the single family

residential detached house or SFR.

Lenders are just like the rest of us—they stick with what they know.

Most lenders will follow Fannie Mae’s guidelines to determine what properties are eligible for loans and

which ones aren’t. Here’s a list of eligible properties according to Fannie Mae.

Eligible Property

1 - 4 unit Single-Family dwelling (detached, semi-detached, attached);

Unit within a planned unit development (PUD) (detached, semi-detached, attached);

Unit within a condominium building with no restrictions on the number of stories.

Eligible Structure

Site Built;

Modular Precut/Panelized Housing.

Ineligible properties according to Fannie Mae are:

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

10

Ineligible:

Manufactured Housing:

Condo-hotels (condotels);

Non-warrantable condos;

Boarded-up Properties;

Post-Pier-Beam, Stilts and Cantilevered foundations (may be considered on a case-by-case

basis);

New properties without a satisfactory Certificate of Completion or Certificate of Occupancy

and a final appraisal certifying completion and value;

Commercial properties;

Co-ops;

Property damaged or deteriorating, such that if it is prohibitively expensive or unfeasible to

restore the structure to habitable condition;

Economic Life of Less than 30 Years;

Properties with current or potential environmental hazard risk;

Properties with marketing time in excess of nine (9) months;

Properties that are not insurable because they are situated in a flood hazard area not eligible

for participation in the National Flood Insurance Program;

Properties with identified potential for property damage from local geological conditions;

Properties located on or near hazardous waste sites;

Properties designated by the appraiser as "Not highest and best use;"

Houseboats, including those permanently affixed to piers, docks, or moored to land;

Properties that are a wholly illegal or non-conforming use for the site;

Illegal/Ineligible Improvements/Additions;

Properties that are an imminent threat to the health or safety of the occupant;

Properties with less than present code foundations (i.e., mud sills, unreinforced brick, concrete

blocks) and residential properties that are not permanently affixed by a foundation;

Properties without permanently affixed legal heating systems (not space heaters or fireplaces);

Properties that lack city or county maintenance or services;

Properties without full utilities installed to meet all local health and safety standards including:

Continuing supply of potable water, public sewer or certified septic system, public electricity,

natural or LP gas;

Vacant land or properties that are effectively vacant land (i.e. improvements contribute 10%

or less to the total value), value will be given only to the lot with residential improvements;

Properties with more than four (4) units;

Properties listed for sale within the past six (6) months;

Properties with severe location detriments;

Poor marketability’s (access, condition, etc.);

Mobile Homes share all the same characteristics as Manufactured Homes (see definition)

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

11

except that they were built prior to June of 1976 when the Federal Manufactured Home

Construction and Safety Standards (HUD code) became effective;

Identified recent or pending zoning changes which would have a negative or destabilizing

impact on residential market values;

Raw Land;

Resort properties that are not within a reasonable commuting distance of employment

centers;

Rooming and Boarding Houses;

Timeshares;

Working farms where the Borrower’s income is derived from use of the land (agriculture,

horse ranch, etc.);

Residential properties that are not permanently affixed to land by a foundation;

and

2-4 units within a PUD

Condominium projects with recreation leases

Manufactured Homes purchased from a Manufactured Home dealer

Properties that cannot be rebuilt 'as is' if destroyed

And I can add two that I have been asked about recently—geodesic domes and abandoned school

busses with no electricity or plumbing. Don’t ask.

Now, I don’t want you to look at this list and freak out. Just because the agencies deem it ineligible,

there are lenders out there that specialize in ineligible properties.

One very important thing to remember is just because a property is eligible doesn’t mean you will be

able to get 90% financing for it. For example, some lenders will offer 90% financing on single family

residences but only 85% on triplexes.

For investors you will usually be able to find 90% financing for

residential 1-4 unit properties and condos.

Condo Secrets

Condos need a chapter all of their own because there are a ton of

special rules and guidelines, secrets if you will, regarding condos.

A condo will be deemed by the lender as either warrantable or

non-warrantable. A warrantable condo will usually sail through

for any type of financing but a non-warrantable condo requires a

special lender.

Condominiums create additional risk because the homeowners’

QUICK SECRET NO. 1

If you buy condos,

ask to see the HOA

questionnaire to make

sure that your condo is

warrantable and there

aren’t any problems

financial or otherwise

with the home owners

association.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

12

association has legal rights that could adversely impact the lender’s rights. Prior to funding a loan a

lender will require that a HOA fill out a questionnaire. Each lender has a standard form and this is how

they get info about warrantability, etc. If an HOA seems iffy, it’s not a bad idea to have your broker have

them fill out the questionnaire before you make an offer. at way you know before you even make an

offer if there will be issues regarding the project.

I once had a client that had a bunch of condos in the same development under contract. ese condos

were all in foreclosure and we suspected that the HOA was pretty shaky. e lender required the

questionnaire from the HOA and they said that they could never get a hold of the manager. I called

my client and told him what was going on and he said, “Well, he doesn’t have a computer and his phone

got shut off but I can go knock on his door and see if he’ll give me the records.” Um, yeah. Good luck with

that.

Generally, lenders do not want to lend on more than 20% of the total units in a project, will not lend if

the HOA is involved in any type of litigation, and if there is commercial space (i.e. first floor restaurant,

deli, hair salon, grocery store, etc.,) there should be no more than 20% commercial space within the

building.

Additionally, lenders like to see that the project is at least 90% completed, that no more than 10% of the

units are owned by a single entity, that it is no more than four stories and that at least 50% of the units

are owner occupied.

I just had a deal where the HOA was being sued by a home owner and the lender declined the loan. I

requested a copy of the suit from the attorney and discovered that it was all over a “funny smell” in one

unit. Because the litigation did not involve a structural issue, the lender reconsidered and approved the

loan. Oh, and my borrower (also my nephew) reports that his unit smells just fine.

Rural Property Secrets

Real estate investors are everywhere and not all of them have the advantage of living in metropolitan

areas. Unfortunately, rural properties and properties with a lot of acreage can be difficult to

finance. e main reason for this problem is that the value of the property can often be difficult to

determine.

Appraisals rely heavily on comparable sold prices within a mile or so of the subject property. In a rural

area with houses far away from each other, it’s hard to get good comps. ese homes tend not to sell

very quickly and the lender may shy away since their main concern is always about taking the property

back through foreclosure.

Usually, lenders will require larger down payments on these types of properties.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

13

Mobile Home Secrets

ere are investors that invest in mobile homes as rentals and they do very well. Financing mobile

homes, especially as a non-owner occupant, is difficult. Mobile homes, also known as manufactured

housing, are not universally liked by lenders. If you are considering investing in mobile homes here are

a few guidelines to follow to ensure you can get these things financed:

Make sure the mobile home was manufactured later than 1976. All manufactured homes built

since June 15, 1976, must conform to the HUD Code, a building code administered and

enforced by the U.S. Department of Housing and Urban Development. Manufactured homes

are the only form of housing constructed to comply with a national building code. Look for the

HUD certification label on the home.

Make sure it is a double-wide.

Make sure it is on a permanent foundation with all wheels, axels, and hitches removed.

Make sure you have a down payment. High LTV financing is not available for investors on this

type of property.

Loan Application Secrets

Fannie Mae form 1003 is also known as the Uniform Residential Loan Application. All lenders are

required to use this industry specific form. If you have applied for a mortgage before, I’m sure you have

completed or at least signed one of these documents. e document is usually five pages long and has

nine sections:

e type of mortgage and terms of loan

Property information and purpose of the loan

Borrower Information

Employment Information

Monthly Income and combined housing expense

information

Details of the transaction

Declarations

Acknowledgement and agreement

Government monitoring section

For investors, you’ll want to make sure that the application states you are purchasing an investment

property and in the declarations, state that you do not plan to reside in the property. Sometimes my

1.

2.

3.

4.

1.

2.

3.

4.

5.

6.

7.

8.

9.

QUICK SECRET NO. 2

Make sure to never let

the name of your LLC

have anything to do with

real estate investment.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

14

clients will mark up the application and change the amount owed on credit cards or installment loans.

Don’t do this. is information is usually automatically populated from the credit report so when

completing the application it’s important that the numbers match the credit report.

Another thing to remember, with regard to your employment on a loan application, NEVER claim that

you are a real estate investor. You might as well say you’re a drug dealer in terms of what an underwriter

will think of you being a real estate investor. All it means to them is that if you are investing in real

estate as a job there is really no way for you to earn regular income. It means that you are waiting for

houses to sell or conditions to be right so you can purchase additional inventory for your business so

you can flip that inventory. ey don’t ever like to see employment that has anything remotely to do

with real estate investing.

If you are a new investor just setting up your entity, and I could give you one good piece of advice it

would be please don’t name your company something like Foreclosure Investment Specialists, LLC or

Real Estate Investment Services Inc., or anything like that. is will be a big tip off to the underwriter

as to what you do. In fact if you are self employed (and I do this with my self employed real estate

clients that invest full time), I would prefer to say you are involved with property management or that

your company does home improvements instead of saying you are a real estate investor just so we don’t

raise any eyebrows.

Ok, back to the application. If you recently paid something off and it has not been reflected in your

credit report yet let your broker know, especially if it’s really affecting your debt to income ratio. If you

provide proof of the payment the lender can usually get a quick update from the credit bureau to reflect

the lower balance.

Also, make sure to check your income and list of real estate

owned very carefully. Remember you are signing a legal

document so use appropriate care.

For purposes of the application you will need to also submit

some documentation to support what you have stated in the

loan application. e documentation will vary based on the

documentation type loan you have chosen (full doc, stated

income, no doc, etc) but for now we will assume that you are

applying for a full doc loan.

e standard list of documents your broker will need to

include in your loan package are:

Verification of income

Earnings statements: W-2 forms, recent pay stubs and tax

returns for the past two years;

QUICK SECRET NO. 3

If you are using rental

income to qualify for

a loan remember that

you are only allowed to

use 75% of that rental

income for income

qualification purposes.

Lenders don’t let you

use 100% of the income

to allow for expenses.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

15

If you are self-employed: profit and loss statements and tax returns for current year and previous

two years;

Additional income: social security, overtime bonus, commission, interest income, veteran's

benefits and so on.

If you have rentals and you are using rental income to qualify, the lender will also want to see

a copy of the lease(s). Most lenders will only count 75% of the gross rental income as income.

is means that if your lease says you collect $1000 rent each month the lender will only give

you income credit for $750 so plan accordingly!

Verification of your assets

Checking and savings account statements for the previous 2-3 months;

List of savings bonds, stocks or investments and their approximate market values.

Information about the purchase

Copy of the ratified purchase contract

Copy of the earnest money check

Your debts

Evidence of mortgage and/or rental payments

Copies of alimony or child support or divorce decree if applicable.

Lenders may also ask you about the origin of your down payment. If the money for the down payment

is a gift from a relative, get a gift letter and copy of the gift check. e gift letter states that the money

will not have to be repaid.

Keep in mind that different lenders may have slightly different information requirements, so these

requirements may vary. Also, after your loan is submitted to the lender and goes through underwriting,

your broker may need to get additional documentation from you that the underwriter requests so be

ready!

Pre-Approval Secrets

is is a good one. Buyers with a mortgage pre-approval have a huge advantage when they are making

offers on properties. A pre-approval shows the seller that you are a fully qualified buyer with financing

already in place and can sometimes make the difference between a seller choosing to accept your offer

over another offer.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

16

Pre-approval will determine the maximum you can spend on a house before you shop, so you know

what price range to target. Many buyers aim too high, bidding on a property that they later learn is

beyond their means because of debt to income issues or due to cash flow issues relative to the monthly

mortgage payment (in the case of a rental).

e contract you sign when you make an offer on a property allows a finite period in which to find a

mortgage—typically 30 days or less. If you fail to secure financing within that period, the seller may

cancel your contract and you lose your earnest money.

Pre-approved buyers can usually close more quickly and that is a bonus to a seller. Ultimately, being

pre-approved gives you bargaining power.

Some brokers pre-qualify applicants based on a cursory check, never actually pulling credit or verifying

assets and income which is necessary to guarantee a loan. Without these steps, it’s not a true pre-

approval and it carries no weight. In a true pre-approval, the lender will give you a letter bearing your

name and the maximum loan amount you are pre-approved for.

e length of the pre-approval process varies, depending on the lender and applicant. Some brokers

can complete it in a few hours. Lenders that promise 20-minute pre-approval usually take that amount

of time to gather and discuss the applicant’s information, but the approval is still pending a review of

the applicant’s resources, income and debt.

e next step in this process, the actual underwriting or final approval, happens after your offer has been

accepted and your loan has been processed, packaged and sent to the lender. Once all the underwriting

conditions have been satisfied, the underwriter will issue the final approval and give your broker the

clear to close!

Reserve Secrets

When you apply for a mortgage there will usually be what’s known as a reserve requirement. is just

means that in addition to your down payment and closing costs the underwriter wants to make sure

you have some money in the bank to cover the first few monthly payments. e requirement varies

from lender and loan product but as an investor you should try to have a minimum of six months

payments in reserves. e reserve requirement on refinances and owner occupant purchases can be as

little as zero to two months.

Some lenders will also require that these reserves be seasoned and sourced. “Seasoned” means that

you can prove that you have had the money for 60 days or so. is is usually determined from your bank

statements. When they want to “source” the money that means that if all of a sudden a huge deposit

shows up on your bank statement, the underwriter will want to know where it came from. In this

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

17

situation they may ask you to provide documentation of the source of the money. For example, if you

just sold a house they may ask for a copy of the HUD1 settlement statement to source the money.

If you are going to have a problem sourcing and seasoning your cash to close, then let your broker

know. Sometimes there are ways around using your statements to source and season the money such as

obtaining a Verification of Deposit from your bank.

Some lenders will require 6 months’ PITI per property owned so make sure you get the details of what

they require early in the process since that can really add up!

Loan Product Secrets

e loan product that you select for financing an investment property is probably the most important

decision you will make with regard to your profitability. is decision is also wholly dependant on

your exit strategy. Before you ever make an offer on a property, you should have an idea of what your

intention is with regard to your particular investment strategy and ultimately your exit strategy. is

will naturally lead you to the correct loan product for your investment goal.

T

. S,

. T

,

.

A fixed rate mortgage is one that has the same rate for the loan term—usually 30 years. e rate will

never change during the course of your loan.

An adjustable rate mortgage is different. ere will be a fixed rate period—anywhere from one month

to ten years. After that period is up your loan will adjust and your rate will change. ARM payments are

based on the index plus the margin. e final rate will be known as the fully-indexed rate.

e most common mortgage loan indexes or indices if we’re being grammatically correct are:

Prime Rate

11

th

District Cost of Funds Index (COFI)

1 Year Treasury (CMT)

12 Month Treasury Average (12MAT/12MTA)

Fed Funds Target Rate

Certificates of Deposit Index (CODI)

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

18

Cost of Savings Index (COSI)

1 Month LIBOR

3 Month LIBOR

6 Month LIBOR

1 Year LIBOR

CMT, COFI, and LIBOR indexes are the most frequently used. Approximately 80 percent of all the ARMs

today are based on one of these indexes. You can find historical comparisons of these indices and their

comparative volatility online.

e Secret of Determining Your Interest Rate

Let’s say you have a 5/1 LIBOR ARM. is means that you have an adjustable rate mortgage that is

fixed for the first five years of the loan term. After that the rate will adjust to the LIBOR index plus the

margin agreed to at the start of your loan. e margin is the number of percentage points (for example,

2.75) the lender adds to the index rate to calculate the fully indexed interest rate at each adjustment.

e margin is set in the mortgage contract, remains fixed for the term of the loan and is not impacted by

the financial markets and movement of interest rates. When trying to determine margin, just know that

the less money you put down and the less documentation you provide, the higher your margin will be

.

Additionally, ARMs will have what is known as rate caps. Rate caps limit how much interest you can be

charged. ere are two types of interest rate caps associated with ARMs. Periodic caps limit the amount

your interest rate can increase from one adjustment period to the next. Not all ARMs have periodic rate

caps. Overall caps limit how much the interest rate can increase over the life of the loan. Overall caps

have been required by law since 1987.

A payment cap limits how much your monthly payment can increase at each adjustment. ARMs with

payment caps often do not have periodic rate caps.

Example Life-Time Cap:

ARM : .

ARM : .

L-T C:

C I : . ( + )

When your fixed rate period is over let’s say that the ARM index rate has jumped to 8%

e new interest rate equals 8% + 2.5% = 10.5%

e life-time cap limits the new interest rate to: 4.5% + 4% = 8.5%

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

19

Example Adjustment Rate Cap:

ARM : .

ARM : .

P A R C:

C I : . ( + )

e ARM index rate has jumped to 6%.

e new interest rate equals 6% + 2.5% = 8.5%.

e adjustment rate cap limits the new interest rate for the adjustment period to: 4.5% + 1% = 5.5%.

So your new rate will be limited to: 5.5% + 2.5% = 8.0%.

Rate caps may not be important to you now but they should be a very important factor when deciding

to go with an adjustable mortgage over a fixed rate. You do not want to experience payment shock when

your initial fixed rate period is up and you adjust to the fully indexed rate. It could wipe out all of your

monthly cash flow and more on a rental.

Amortization Secrets

A ., ,

, ,

. S

.

Amortization really just has to do with the ratio of principal and interest to be paid with each payment.

Your broker can provide you with an amortization schedule that shows the amount of principal and

interest made with each monthly payment.

Here is a snapshot of a sample 3 year amortization schedule of a $100,000 loan at 7% interest:

Principal Interest Cum Prin Cum Int Prin Bal

1 81.97 583.33 81.97 583.33 99918.03

2 82.44 582.86 164.41 1166.19 99835.59

3 82.93 582.37 247.34 1748.56 99752.66

4 83.41 581.89 330.75 2330.45 99669.25

5 83.90 581.40 414.65 2911.85 99585.35

6 84.39 580.91 499.04 3492.76 99500.96

7 84.88 580.42 583.92 4073.18 99416.08

8 85.37 579.93 669.29 4653.11 99330.71

9 85.87 579.43 755.16 5232.54 99244.84

10 86.37 578.93 841.53 5811.47 99158.47

11 86.88 578.42 928.41 6389.89 99071.59

12 87.38 577.92 1015.79 6967.81 98984.21

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

20

Even though this just shows the first 12 payments, you will see that as the payments go on, the amount

of principal you pay increases while the amount of interest you pay decreases.

T ,

. A ,

.

Here are the first 12 payments for that same loan amortized over 15 years:

Pmt Principal Interest Cum Prin Cum Int Prin Bal

1 315.50 583.33 315.50 583.33 99684.50

2 317.34 581.49 632.84 1164.82 99367.16

3 319.19 579.64 952.03 1744.46 99047.97

4 321.05 577.78 1273.08 2322.24 98726.92

5 322.92 575.91 1596.00 2898.15 98404.00

6 324.81 574.02 1920.81 3472.17 98079.19

7 326.70 572.13 2247.51 4044.30 97752.49

8 328.61 570.22 2576.12 4614.52 97423.88

9 330.52 568.31 2906.64 5182.83 97093.36

10 332.45 566.38 3239.09 5749.21 96760.91

11 334.39 564.44 3573.48 6313.65 96426.52

12 336.34 562.49 3909.82 6876.14 96090.18

You can see that this is a much more aggressive payment schedule.

A

, . F

’

. I’

.

Secret Loan Features for Investors

It’s very important to understand the difference between a loan product and a loan feature. It may help

to think of the concept in terms of a car. You buy a certain model but that model has additional features

that you pay extra for—same with loans. Just remember, if you add these features to your loan, it will

usually cost you a little more in rate each month.

Here are some loan features that are popular with investors:

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

21

Interest Only

is is probably hands down the most requested loan feature for investors. It is a way to reduce

your monthly payment (and increase your monthly cash flow) by paying only an interest

payment each month—no principal.

Not paying principal each month means that you are relying solely on appreciation to increase

the equity in your property, so make sure you are only applying this feature on those properties

that you feel will appreciate a little faster than normal.

When this feature was first introduced it was usually a free feature. Now lenders charge anywhere

from .125 to .500 for the feature, so do the math before you decide if it will work for you. For

example, take a look at this scenario:

L : ,

I :

I O : .

Your fully amortized payment (principal and interest) will

be $1330.60*

Your interest only payment will be

$1229.16 (200,000 * 7.375%/12).

You will save $100 a month but is it worth it to pay a higher

rate and not have the benefit of principal reduction/equity

increase to save $100/month? Only you can decide.

* You can find a free calculator online that will calculate this for

you at http://www.realdata.com.

Waive Escrows

As an investor, sometimes you prefer to pay the taxes and insurance separately from the mortgage.

You can do this if you choose to not allow the lender to set up an escrow account to collect

and pay the taxes and insurance on your behalf. is is known as “waiving escrows” or “no

impounds”. Escrows are also referred to as “prepaid closing costs”.

If you are putting 20% down on the deal and your loan to value is 80% or less, then the

lender doesn’t really care and will charge nothing for this feature. If you are using higher LTV

QUICK SECRET NO. 4

If your deal is 80% LTV

or below (meaning you

are putting down 20%)

you can waive escrows

in order to reduce your

closing costs. That

means you will not have

to fund your escrow

account for taxes and

insurance at the closing.

That will really reduce

your closing costs.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

22

financing, then the lender does care and this feature will usually cost

you .250. e advantage to waiving escrows can really be seen at

closing. Since you have to fund your escrow account at closing, you

can actually use waiving escrows as a strategy to reduce your out of

pocket closing costs.

40 year amortization

40 year amortization is a feature that was introduced to give the

advantage of an interest only payment and the benefit of a principal

reduction each month. If we use the same loan scenario from

above and assume that this feature will also cost us .375 in rate, the

monthly payment will be $1297.70. It kind of lands you halfway between the interest only and

the 30 year. Again—an option.

Hard Money Loan Secrets

Hard money loans are also known as asset based loans. Investors are usually trained to finance their

acquisitions with this type of loan because the property qualifies—not the borrower.

Investors are told all the time to just go get a hard money loan. is way, your credit and assets will

never be a factor in the decision AND you can close fast.

is was very true back in the old days when a rich guy would loan an investor 65% of the value of the

property just by looking at the house and doing some quick comps. e rich guy would not require a

credit check and could close quickly with cash. e rich guy did this because he charged big fees (5%

or so in points) and high interest rates (10-18%). And he figured that there was plenty of equity in the

place if he ever had to foreclose on the investor. Sometimes the old rich guys made these loans because

they WANTED to foreclose on the properties!

It’s rare today to find a true, old-fashioned asset based loan. Most hard money lenders today prefer to

be called private money lenders and will require some sort of qualification for the borrower in addition

to the property. Sure, the credit score requirement will be lower than a conventional lender but be

prepared to disclose some information to the private money lender.

For example, here are the products and requirements of our most popular hard money fix&flip loans:

70% LTV Program

15% interest only payments

QUICK SECRET NO. 5

Choose a 40 year

amortization over

an interest only loan

to get some principle

reduction if you

will be holding the

property long term.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

23

3 points origination

Minimum credit score of 640

Full subject-to appraisal is required to determine ARV.

Today the real advantage of using a hard money loan instead of a conventional loan lies in the fact

that the hard money loan LTV is based on the value of the property subject-to the repairs being made

instead of the as-is value. Conventional lenders have the “lesser-of” rule which states that the loan

amount will be the lesser of the sales price or the appraised value.

Obviously as an investor buying fix up properties, your sales price will be significantly lower than the

value of the property.

My opinion, in case you were wondering, is to use hard money to fund the acquisition and

repairs, then do a conventional rate and term (no cash out) refinance to cut your holding costs in

half and/or greatly improve your cash flow.

Rate Secrets

Who has the best rates? Wholesale, Correspondent or Retail?

Wholesale, Correspondent and Retail are the three origination

channels in residential mortgage lending. e best rates may be a

relative thing but I will give you some information that may help

you with your decision.

If you just walk into a strip mall office of a lender like Countrywide

or Washington Mutual, you are walking into a retail origination

office. eir secondary marketing office each day publishes a

rate sheet for them with all of their available loan programs and corresponding rates. It is generally

accepted that these rates are higher than the rates the same institutions offer to their wholesale brokers

or correspondent lenders.

I worked in secondary marketing at a correspondent lender and each morning we would publish a

rate sheet for our internal loan officers or originators. is was a national home builder. We would

download the correspondent rate sheet from the lenders we sold to each morning and then MARK

THEM UP by a certain percentage that varied by loan product. We would do this before ever releasing

the rate sheets to our own internal loan officers so the par rate that they were offering to their borrowers

was not a par rate at all. It had premium built into the rate already.

Even if the customer asked to see the rate sheet, they would think they were getting a par rate because

that’s what the rate sheet said—but they were paying mark up on that rate. Additionally, we would

QUICK SECRET NO. 6

Use yield spread

premium to pay some

closing costs or buy

down the interest rate.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

24

not have to disclose that rate mark up on the HUD1 settlement statement because as correspondent

lenders we funded the loans in our own name, not the name of the ultimate lender like Countrywide

or Washington Mutual.

If you want to be sure you are getting a wholesale rate and want to have proof of that, then you should

be working with a wholesale mortgage broker. Ask to see the rate sheet from the actual lender—not

the broker’s internal rate sheet. And if the rate is marked up and the broker is collecting yield spread

premium, it will be listed on the HUD1 settlement statement. Look around the 800 lines. It will say

POC (paid outside of closing) broker premium somewhere around in there if it is being paid to the

broker. It will not be listed in the borrower’s or seller’s column but on one of the actual 800 lines.

e Biggest Secret of All—Yield Spread Premium

Yield Spread Premium or YSP is the real secret in mortgage finance. is is the premium that the

mortgage lender or bank pays the broker to sell you a higher rate. e higher the rate the broker can

sell you, the higher the commission on the “back end” of the deal.

To understand rates and their corresponding price, you must travel back with me to high school

math where we learned about bond pricing. Remember par, premium and discount? e rates that

lenders offer can be priced at par, premium or discount. Let’s say that the table below is sample

pricing for Acme Funding. Acme sends these rate sheets to lenders and brokers all over the country

saying “Hey – here’s what our rates are today!”

30 Year Fixed

RATE PRICE

6.000 99.000

6.125 100.000

6.250 101.000

What this means is that if I offer a rate of 6.000 to my borrower, then I have to pay a point (1.000) in discount

in order to get that rate. On a $200,000 loan that means we’re bringing an extra $2000 to the closing table.

If I offer my borrower a rate of 6.125 then it’s a wash. He doesn’t have to bring any extra to the table

and I don’t make any extra commission from the lender to sell this rate. is is this PAR rate.

Now, if I can get my borrower to agree to a rate of 6.250 then this is a PREMIUM rate—higher

than the going rate—so the lender is paying me a commission of a point (1.000) on the deal. I make

$2000 extra commission.

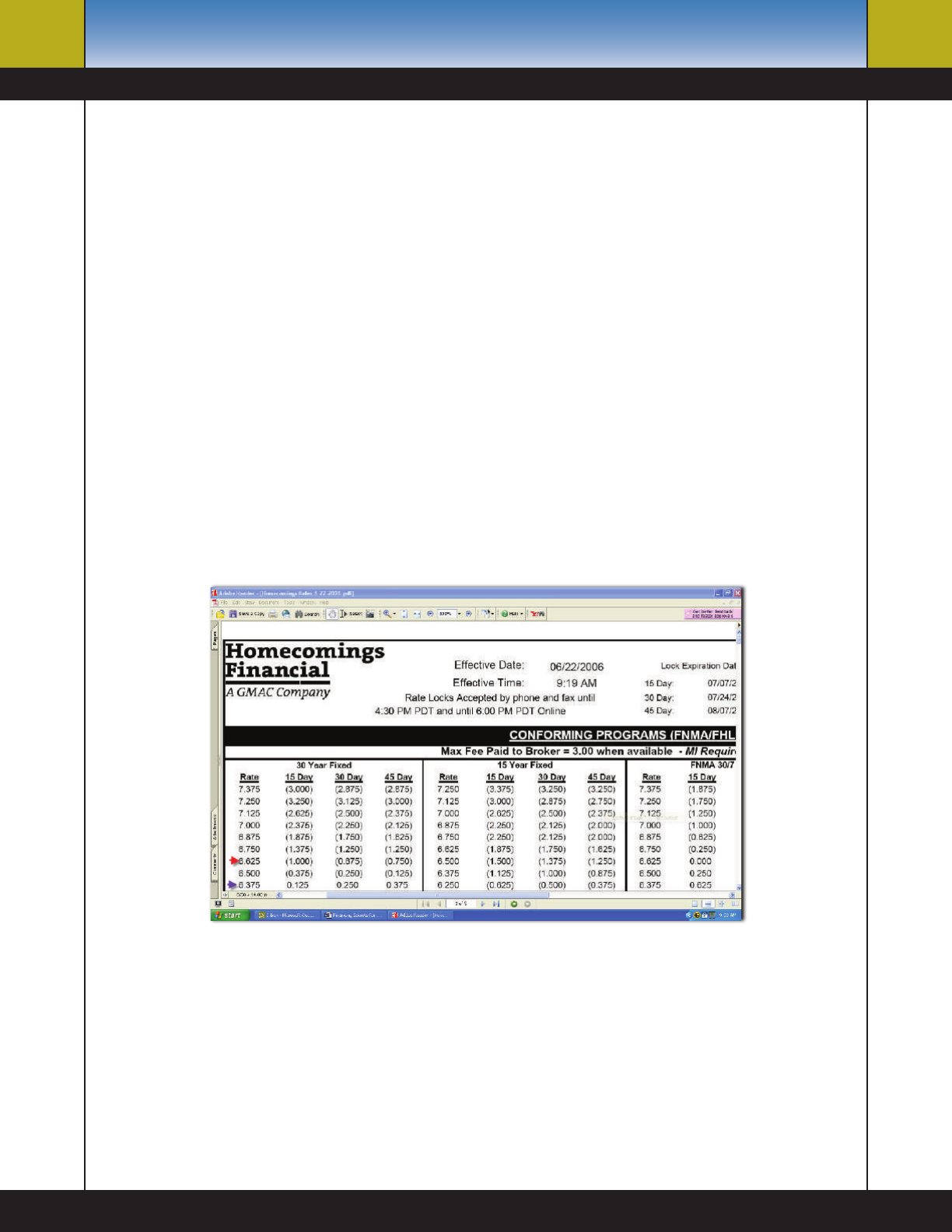

Here’s what a real rate sheet looks like.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

25

You can see in the example above that Homecomings is the lender. Look at the 30 Year Fixed box above

and you can see a list of rates offered from 6.375% all the way up to 7.375%. e purple arrow shows

you that 6.375, on a 15 day lock, costs .125 in discount. If you wanted this rate today, you would have

to pay .125% of the loan amount to get it. On a $200,000 loan that’s $250.

If the broker can sell you the 6.625% rate then she can actually make one point (1%) in Yield Spread

Premium on this deal.

Now what if you had a broker who was trying to sell you a rate of 7.375? at broker is making 3% in

YSP—a whopping $6000 on a $200,000 loan.

YSP is required to be disclosed on the HUD1 settlement statement if the broker you are using is a wholesale

broker, meaning they fund the loan in the lender’s name, Homecomings Financial, not their own.

If they are a correspondent lender, this means that they actually fund your loan in their own name,

Acme Funding, from a line of credit and then they sell the closed loan to the lender. If this is the case,

then they DO NOT have to disclose the YSP on the HUD1 settlement statement. You never know at

that point how much extra profit they have made by selling you a higher rate. To protect yourself, ask

your mortgage broker to show you the rate sheet. ey won’t want to and they’ll probably tell you that

it’s private, just for internal use, for mortgage professionals only, etc., but if they want to show you they

can. ere is no law prohibiting it. So, ask and the answer you get will tell you a lot about the broker

you’re working with and the rate that you’re being offered.

Now I want to stress that YSP is not always a bad thing. Sometimes it can actually save you money!

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

26

Mortgage brokers have to be compensated for their work so they must be paid somehow. I personally

tell all my investor clients that I must make 1% on each loan that I do. It is up to the client to tell

me where to get my paycheck—either on the front through origination or on the back through YSP.

Sometimes, it is less expensive to pay me with YSP—especially if it is a fix and flip—since it reduces the

buyer’s out of pocket costs. If you end up paying .250 more in rate and you’re only keeping the property

six months then it’s no big deal and can even increase the profitability on your flip if you finance the

origination with YSP. On a $200,000 loan the difference between a payment at 6.000 and 6.250 is

only $32.33 a month. For six months you only end up paying $193.98 by financing the origination

instead of paying 1% at closing. You save $1806.02!

Sometimes, you can even have the seller pay your broker and I show you how in the case study in the

next section.

Seller Concession Secrets

May times, in order to entice a buyer to purchase a house, sellers will offer special incentives. ese

incentives are called “seller concessions” or “seller contributions” and they are essentially using proceeds

from the sale to offset closing costs. e size of seller concessions is limited by the lender.

Here’s the Fannie Mae rule about seller contributions:

S (

, - )

:

Primary Residence and Second Home

If LTV is > 90% maximum contribution is 3%

If LTV is < 90% maximum contribution is 6%

If LTV is < 75% maximum contribution is 9%

Investment Property

Maximum contribution for all LTV’s is 2%

NOTE: Contributions must be calculated based on the CLTV when a mortgage is subject to subordinate

financing for purposes of determining whether it complies with the maximum contribution limits.

So you can see that once again investors get the shaft! Just kidding—there are many conventional loan

programs that will allow up to 6% seller contributions for investors. Just make sure you know the rule

about your specific loan program before you write the offer to ensure you are maximizing the seller

contributions on your deal. And remember this is a % of the purchase price—not the loan amount!

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

27

But you should also be careful because you don’t want to get so much that the lender starts to question

the value of the property. If seller concessions go beyond program limits, a lender might think that

the house is overpriced. Yes, a house may have “sold” for $100,000, but if the seller had to give up

$10,000 in concessions, what’s the house really worth, $100,000 or $90,000? A lender would likely say

$90,000. In this case, either the buyer must come up with more cash, the owner must lower the sales

price, or there must be some combination of concessions.

C S—Seller Paid Origination

You are making an offer on a duplex that is listed for $180,000. e property has been on the market

for a while and you think that the seller will be happy to offer some “concessions” or seller contributions

in order to get the deal done. You know that your broker will charge 1% origination or $1800 on this

deal if you offer full asking price, so figure your maximum offer and then ask the seller to also kick in

$1,800 in closing costs. e seller won’t actually have to give you $1,800 cash; it just gets deducted

from his proceeds at the closing table.

Make sure you don’t increase the sales price or your maximum offer in order to get this concession,

though, or you are just financing it.

Interest Rate Buy Down Secrets

An interest rate buy down is a way to use yield spread or discount points to arrive at a specific interest rate

for the life of the loan. e most common buy down is the 2-1 buy down. In the past, for a buyer to secure a

2-1 buy down they would pay 3 points in order to pay a below market interest rate during the first two years

of the loan. At the end of the two years they would then pay the old market rate for the remaining term.

For example, if the current market rate for a conforming fixed rate loan is 8.5% at a cost of 1.5 points,

the buy down would cost a total of 4.5 points giving the borrower a first year rate of 6.50%, a second

year rate of 7.50% and a third through 30th year rate of 8.50% and the cost would be 4.5 points.

In today’s market, lenders have designed variations of the old buy downs. Instead of charging higher

points to the buyer in the beginning, they increase the note rate to cover their yields in the later years.

For example, if the current rate for a conforming fixed rate loan is 8.50% at a cost of 1.5 points, the buy

down would give the buyer a first year rate of 7.25%, a second year rate of 8.25% and a third through

30th year rate of 9.25%, or a three quarter point higher note rate than the current market and the cost

would remain at 1.5 points.

Another common buy down is the 3-2-1 buy down which works much like the 2-1 buy down, with the

exception of the starting interest rate being 3% below the note rate. Another variation is the flex fixed

buy down programs that increase at six month interval rather than annual intervals.

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

28

As an example, for a flex fixed jumbo buy down at a cost of 1.5 points, the first six months rate would

be 7.50%, the second six months the rate would be 8.00%, the next six months rate would be 8.50%,

the next six months rate would be 9.00%, the next six months the rate would be 9.50% and at the 37th

month the rate would reach the note rate of 9.875% and would remain there for the remainder of the

term. A comparable jumbo 30 year fixed at 1.5 points would be 8.875%.

Buy downs are complicated and I don’t use them much on investor loans but it’s another tool for you

to have if the situation warrants.

Rate Lock Secrets

Rates on a loan have to be locked in before you can close the deal. On a rate sheet, rates are quoted

with various time frames. For example, going back to our Homecomings rate sheet you can see different

pricing for that same 6.625% rate on the 30 year fixed depending on whether we lock it in for 15, 30

or 45 days. e main thing to remember here is that time is money—the longer you lock the more

expensive it is. If I lock in that 6.625% rate for 15 days I make 1% in YSP premium. If I lock that same

rate for 45 days then I only make .750.

Since rates change often—sometimes even several times a day—choosing just the right time to lock

in a rate is important. I remember working at the mortgage company in Secondary Marketing during

the refinance boom of 2000-2001. e securities traders would tell us just the right time to lock in

our rates on our own refinances. ey didn’t tell the customers that—just the employees! It was great

having my own private insider.

e r

ates that are the most volatile are the agency fixed and ARM rates. Since investors usually are using

non-conforming and sometimes even sub-prime programs, we don’t have to worry as much since these

Mortgage Secrets for Real Estate Investors Susan Lassiter-Lyons

© Copyright 2009. All rights reserved.

29

rates don’t change as often. Still, I will pay attention to the monthly economic indicators as they are

released and make sure I have all the loans in my pipeline locked before the Fed raises interest rates again.

e point here is that if you are using an agency program to finance any of your properties, investment

or otherwise, make sure to work with your broker to lock in a rate at the appropriate time.

If for some reason your loan is not closed by the rate lock date deadline, then you will either have to

re-lock at a higher (market prevailing) rate or extend the lock for a few days for a fee. Either way, if you

miss your deadline you pay so make sure you have enough time to close the loan by the deadline.

Secrets of the Good Faith Estimate

e Good Faith Estimate is a disclosure document that you sign to give you an ESTIMATE of the fees

associated with your loan. It will also show closing costs, insurance and tax reserves, your estimated

monthly loan payment and the amount you will need to bring to or get back at closing. Folks, the

Good Faith Estimate is just that—an estimate. We lenders do the best we can to get as close to the real

figures but sometimes we are off. I figure if I am within a $100 or so then I’ve nailed it.

Sometimes things happen that are beyond our control—like a loan payoff coming in higher than

expected or a delayed closing that has us ponying up a full month of interest. Believe me, as a broker I

hate surprises just as much as my clients do.